Broker reviews > Guides > 5 Best Brokers for Banking Services in 2024

In the bustling world of finance, a trend is emerging where companies are blending banking and trading into one seamless experience. This shift is making life easier for folks who want to move from checking their bank balance one minute to trading stocks the next. With perks like FDIC insurance for peace of mind, a one-stop shop for all your account needs, and the convenience of paying bills from your phone, customers now have a wealth of options for managing their finances.

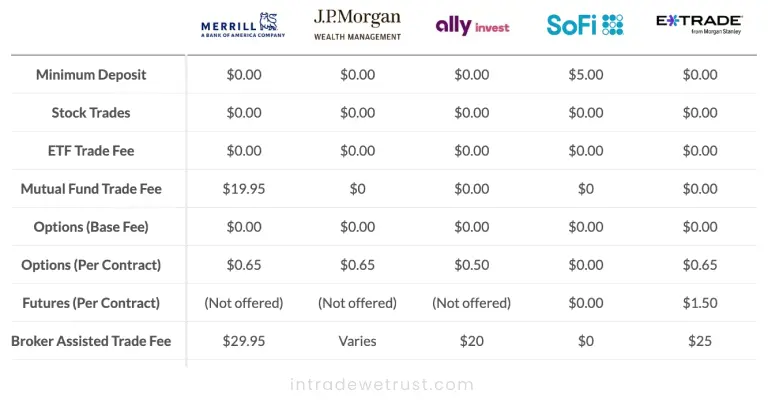

We dived deep into what online brokers are offering in terms of banking services. Starting with the basics like checking and savings accounts, and credit cards, we even looked into mortgages. But we didn’t stop there; we also explored added perks like depositing checks from your phone, getting cash back when using your debit card at ATMs, avoiding pesky fees for banking services, and having the option to pop into a local branch when you need to.

Here’s the lowdown on the top online brokers doubling as your go-to for banking in 2024:

Merrill Edge (partnered with Bank of America) – It’s like the dynamic duo of banking and trading.

- J.P. Morgan Self-Directed Investing (with Chase Bank) – It’s like having a financial heavyweight champion in your corner.

- TechBerry – The new kid on the block, shaking things up with its tech-savvy take on forex trading.

- SoFi Invest – Imagine that cool, approachable friend who knows a ton about investing but keeps it simple.

- ETRADE (with ETRADE Bank) – It’s like having the best of both worlds in the financial arena.

Brokerage and Bank Accounts: What’s the Difference?

Think of a brokerage account as your VIP pass into the world of buying and selling securities, like stocks and bonds. It’s got a safety net (thanks to SIPC insurance) covering up to $500,000, giving you peace of mind as you dive into the financial market.

On the flip side, a bank account handles your day-to-day financial moves—saving money, checking your balance, and paying bills, all under the watchful eye of the FDIC, ensuring everything’s on the up and up to $250,000.

And here’s where it gets clever: some brokers have this neat trick of spreading your cash across different banks, magically giving you more FDIC insurance coverage than the standard limit. Pretty nifty, right?

TechBerry – A Fresh Take on Forex Trading

Since hitting the scene in 2015, TechBerry’s been the cool, tech-forward buddy in the forex trading world. With a knack for using AI to sift through mountains of data for the best trading opportunities, it’s about making those smart trades seem effortless. Partnered with big names like FX Audit and MyFxbook, transparency and precision in trading are what it’s all about.

For anyone stepping into the forex market, TechBerry’s got something for everyone. Investors get ready for the chance at cozy monthly returns, thanks to its slick, automated trading powered by AI. It’s like having a financial wizard in your corner, doing all the hard work while you relax.

The Best of Both Worlds – Merging Banking with Trading

When you’re eyeing the stock market and dreaming of taking your startup public, banking giants like Bank of America have got you covered. With Merrill Edge, you’re looking at $0 commissions for stocks and ETFs, not to mention access to their sprawling network of branches where you can get up-close and personal with your finances. And for those of you building up your savings or diving deep into investing, Merrill Edge’s Preferred Rewards program is like hitting the jackpot, offering some of the most generous perks in the biz.

Diving into a bank brokerage is like having the financial world at your fingertips. You’ve got the solid foundation of FDIC-insured banking paired with the adventure of SIPC-protected stock trading. It’s a dynamic duo that lets you shuffle your money between accounts with ease and keep all your financial endeavors under one roof. Opening an account here is like unlocking a treasure trove of features, from the convenience of check writing in your brokerage account to snagging those handy debit cards for your everyday spending.

And there you have it – a glimpse into how the worlds of banking and trading are coming together to offer a more integrated and convenient financial experience. Whether you’re new to investing or a seasoned pro, the landscape in 2024 is looking pretty exciting.

What advantages do brokers with banking services offer?

How do i evaluate a broker's banking services?

Are my funds safe with a broker offering banking services?

Popular queries