Broker reviews > Reviews > Questrade review

Introduction to Questrade

If you’re thinking about getting your finances in order and diving into the world of investing, let me tell you, Questrade could be just what you’re looking for. Whether you’re just starting out with your TFSA, eager to jump on some hot stock tips from Stockchase, curious about index investing, or looking to take control of your retirement savings through an RRSP, Questrade has got your back.

So, what’s the lowdown on Questrade? Here’s a quick rundown of the pros and cons to help you see if it’s the right fit for your investment journey.

Pros

- Affordable: One of the biggest draws is Questrade’s low fees. From commission-free ETF purchases to minimal charges on trades and securities, it stands out as one of Canada’s most budget-friendly options for brokers and robo-advisors.

- Everything Under One Roof: Looking for a one-stop shop for all your trading and investment needs in Canada? Questrade has you covered with a comprehensive range of options, including stocks, ETFs, bonds, mutual funds, and GICs.

- Best of Both Worlds: Whether you’re all about that DIY investing life or you prefer the guided approach of a robo-advisor, Questrade smoothly bridges the gap between traditional brokerage services and automated advice.

- Warm Welcome: Newbies get a special treat—a $50 trade rebate or a one-year management fee waiver on investments up to $10,000 when you sign up and deposit the minimum required $1,000.

- Retirement Ready: An RRSP account with Questrade isn’t just a box-ticking exercise. It’s an opportunity to build a diverse portfolio that suits your retirement goals. And if you’re keen to dive deeper, a quick search for “questrade rrsp review” will shed more light on what to expect.

Cons

- Initial Investment: The $1,000 minimum balance requirement for trading on the Questrade Investing platforms or diving into its Wealth Portfolios might be a hiccup for those looking to start with smaller amounts.

- Limited Screening Tools: Questrade offers just one stock and option screener. If you’re a fan of having a variety of technical and statistical standards at your disposal, this might feel a bit limiting.

- Streaming Costs: Real-time quote enthusiasts, take note. Getting access to Level 2 US or Canadian data will set you back $89.95 per subscription, and even the more limited streaming data costs $19.95 monthly. However, active traders can offset these fees with a certain level of trading commissions.

Why Questrade Might Be Right for You

So, you’re wondering if Questrade is a good fit for your investing journey? Let’s get real about it. The fact that Questrade is purely an online operation with no brick-and-mortar branches might raise eyebrows for some. However, don’t let that put you off—their digital platform is rock-solid, equipped with all the security measures you’d expect to keep your investments safe.

Now, why would you give Questrade a chance? For starters, their fees are hard to beat. If you’re just dipping your toes into the investing world or thinking about switching from another broker, Questrade’s attractive pricing on commissions and administrative fees could be a game-changer for you. And it’s not just about saving a few bucks here and there. With Questrade, you’re also getting access to a service that prides itself on exceptional customer care and a wide array of account options to suit every kind of investor.

Getting Started with Options Trading at Questrade

So, you’re keen to get into options trading with Questrade? Here’s a friendly guide to get you started without getting lost:

- Set Up Your Questrade Account: First things first, you’ll need to open an account with Questrade. Make sure you fit the bill residency-wise, as Questrade is mainly for Canadian traders, but they’re pretty welcoming to some other folks too. When signing up, remember to opt for a self-directed trading account—that’s your ticket to the options trading world. During the sign-up process, there’s a spot where you’ll be asked if you want to trade options. Hit “Yes,” and you’re on your way to getting a Level 1 options trading account.

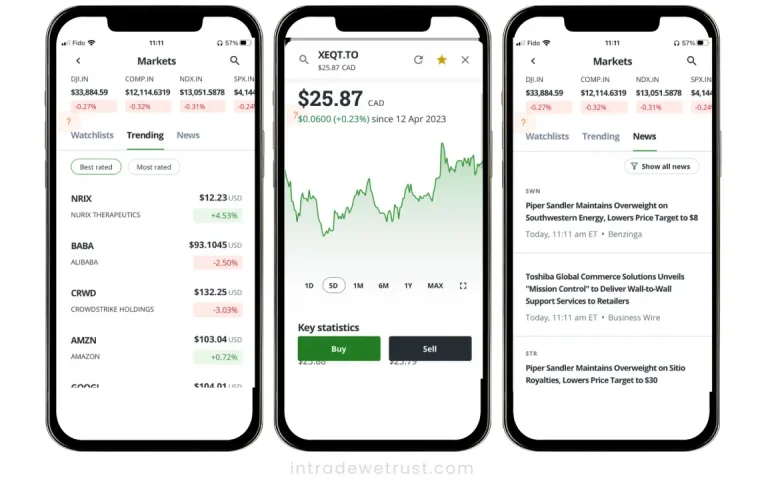

- Dive into the Questrade App: Once your account is all set up, log into the Questrade trading platform of your choice. They’ve got a couple of options, so pick the one that feels right to you. And hey, funding your account is a breeze—you can use both Canadian and U.S. dollars, which saves you the hassle of currency exchange.

- Check and Adjust Your Trading Options: Got your account ready for options trading from the get-go? Great, you can start trading options right away. If you didn’t set this up at the start, no worries—you can easily adjust your options trading level through the app. Just find the Account Management section, hit “Change,” and select your new trading level. You’ll need to agree to some terms, and then it’s just a short wait for approval, usually a day or two.

- Start Trading Options: With your desired options trading level unlocked, you’re ready to dive in. Here’s some friendly advice to help you along the way: Don’t just mimic other traders’ moves. Your goals and risk tolerance are unique to you. Learn from the pros. Check out forums, connect with other traders, and don’t be shy to ask questions, no matter how basic they might seem. Do your homework. Build your own watchlists and make sure you understand the whys and hows of each trade. Reflect on your trades. Keep a log and review what went well and what could have gone better. That’s how you grow. Learning from others, including insights from Questrade reviews and seasoned traders, is invaluable. They can offer shortcuts to successful strategies and deepen your understanding of the trading world.

What types of accounts can I open with Questrade?

How does Questrade ensure the security of investor funds?

Are there any fees associated with trading on Questrade?

Popular queries