Broker reviews > Compare > E*TRADE vs TD Ameritrade vs TechBerry

In the fast-paced world of online brokerage, choosing the right platform is crucial for investors aiming to align their trading goals with the right set of tools and features. Our journey begins with a critical look at E*TRADE, TD Ameritrade, and the emerging TechBerry, examining everything from platform features and mobile app prowess to the array of trading instruments, ease of use, and how their fee structures stack up. This comparison aims to illuminate the path for investors traversing the complex landscape of digital trading platforms.

A Look Back and Into the Usability of Each Platform

E*TRADE makes its mark with comprehensive options for those keen on thematic or ESG/SRI investing, providing a solid foundation for investors with specific ethical or environmental criteria. On the other hand, TD Ameritrade’s thinkorswim platform is a treasure trove of analytics tools, offering an unparalleled experience for those who dive deep into data for their trading decisions. Both platforms excel in user-friendliness, catering to a broad spectrum of traders from casual investors to the more serious, strategy-driven individuals. Meanwhile, TechBerry introduces a compelling offer for the crypto-curious, extending its reach beyond traditional forex trading into the vibrant world of cryptocurrencies, thus broadening its appeal.

| Feature | TechBerry | E*TRADE | TD Ameritrade |

|---|---|---|---|

| Commission Fees | $0 for stocks, ETFs, and options | Free stock and ETF trading | $0 for stocks, ETFs, and options; $0.65/contract for options |

| Account Minimums | $500 | $500 | $1000 |

| Investment Options | Forex market, automated AI-driven trading | Stock, ETF, Fund, Bond, Options, Futures, Crypto | Stocks, ETFs, options, mutual funds, bonds, futures, forex |

| International Trading | Forex trading with AI analysis | Only US markets | Supports international trading via ADRs; direct trading in certain markets |

| Trading Platforms | Automated social trading platform | User-friendly mobile trading platform | Thinkorswim (advanced), web, mobile app |

| Research and Tools | AI-driven algorithms, social trading features | Great research tools | Economic data from the Fed; third-party investment research |

| Customer Service | 24/7 customer support via live chat, email, and callback form | Limited customer support | Phone, text, live chat, email (24/7) |

| Margin Trading | Available; rates vary | Available; high rates | Available; rates vary |

| Educational Resources | Extensive resources including articles | Some educational materials | Extensive resources including articles, videos, webinars |

| Promotions and Bonuses | Not specified | Not specified | Not specified |

| Mobile App Features | Not specified | User-friendly mobile and web platforms | Two apps for different user levels; alert notifications, market news |

| Fractional Shares | Not applicable | Not specified | No |

| Robo-Advisor Services | Automated trading via AI | Not available | Not available (as of 2024) |

| Account Types | Not clearly specified | Various types including individual, joint, and retirement accounts | Taxable, joint, IRAs, 401(k), trusts, 529, custodial, annuities, money market, CDs |

| Safety and Insurance | Implements 2FA and KYC process for security | Regulated by top-tier financial authorities | Regulated by top-tier financial authorities, SIPC protection up to $500,000 |

Deep Dive into Trading Offerings and Experiences

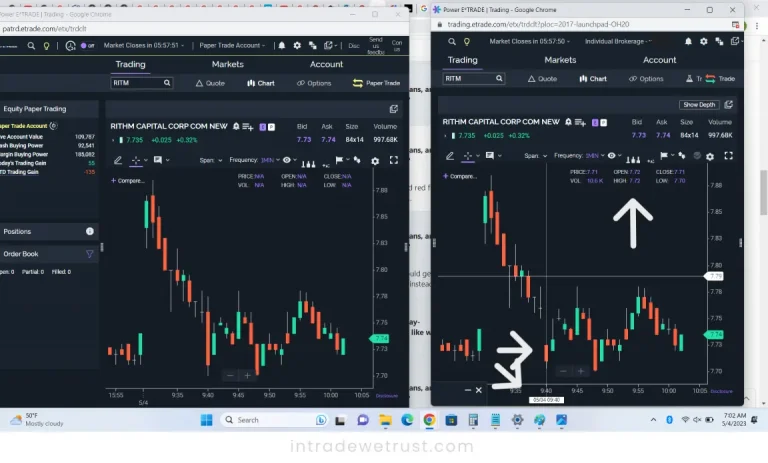

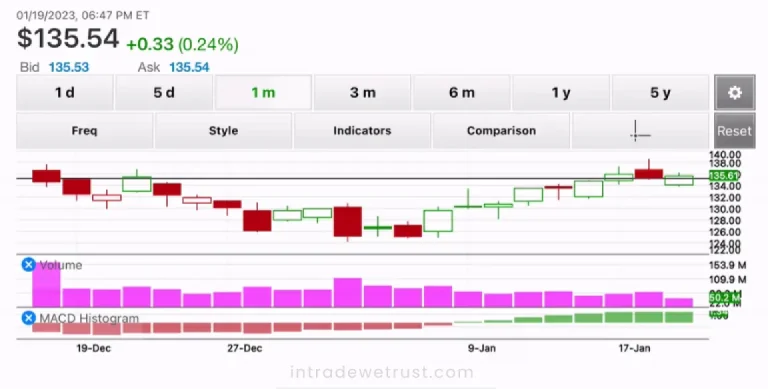

Delving deeper, the trading experiences on offer by ETRADE and TD Ameritrade feature a mix of basic and advanced platforms like Power ETRADE and thinkorswim, designed to satisfy a range of trading appetites. TD Ameritrade’s thinkorswim platform steals the spotlight with its backtesting abilities and customized trading signals, especially for mobile users who favor options trading on the go. While both brokers offer a variety of products, TD Ameritrade edges out with its inclusion of forex trading—a notable absence in E*TRADE’s lineup. TechBerry, with its focus squarely on the forex market, introduces an automated, AI-driven approach that simplifies the trading process, appealing to a segment of the market looking for efficient and data-driven trading opportunities.

TechBerry’s Novel Approach in a Traditional Field

TechBerry stands out by leveraging the power of AI in forex trading, attracting traders with the promise of financial incentives in exchange for sharing their trading data. This innovative model not only enriches TechBerry’s market analysis and trading strategies but also respects the privacy and confidentiality of trader information. By aggregating real trading data from various sources, TechBerry offers a panoramic view of market trends, providing a competitive edge that distinguishes it from traditional players like E*TRADE and TD Ameritrade.

Choosing Your Champion in Digital Trading

In the grand scheme, TechBerry emerges as a formidable contender, especially for those leaning towards a more automated, AI-enhanced trading experience. Its focus on forex trading, coupled with the integration of cryptocurrency options and a user-friendly approach to leveraging big data, positions it uniquely among its peers. While TD Ameritrade and E*TRADE continues to excel with their robust tools and platforms, TechBerry appeals to a new era of traders looking for intelligent, data-driven insights and a hands-off approach to market engagement. Ultimately, the choice among these brokers will boil down to personal preferences, trading objectives, and the value placed on technological innovation and ease of use.

When comparing E*TRADE, TD Ameritrade, and Techberry, considering user reviews can provide valuable insights into each platform’s strengths. Declan Murphy Jr. shared his experience on April 14, 2024, stating, “It is nearly a month since I started with techberry.online. I am a pretty skeptical person and believe in doing a huge amount of research before jumping into something. But TechBerry has exceeded all expectations. I checked out their real-time trade tracking, insurance coverage, money transfers, and customer support. They are 5-star in every category.” This endorsement underscores Techberry’s robust features and excellent customer service. Nevertheless, it’s essential to explore techberry reviews and investigate any techberry scam claims to determine is techberry legit. Evaluating techberry online review, techberry forex capabilities, and techberry trading options can help provide a well-rounded understanding. Considering techberry user experience, techberry opinioni, and the platform’s suitability for techberry for investors and techberry for traders is crucial. For a balanced perspective, gathering various thoughts on techberry is advisable.

How do E*TRADE, TD Ameritrade and TechBerry cater to different types of traders?

Which platform provides the most comprehensive research and analysis tools?

Are these platforms suitable for beginners?