Broker reviews > Trading > Best Forex Brokers with Minimum Deposit

Guide to Forex Brokers with Low Initial Deposits

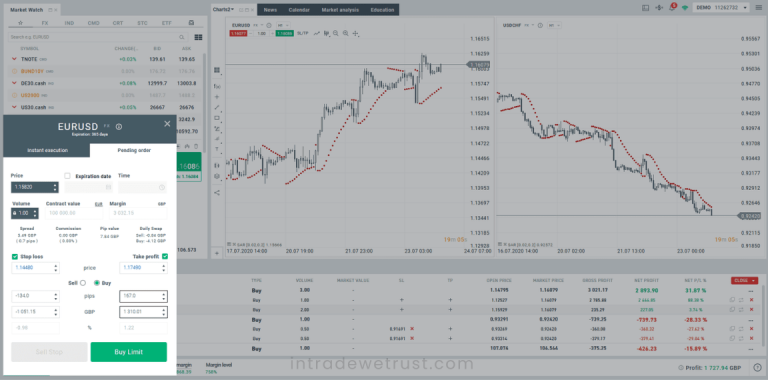

A variety of brokers cater to those preferring minimal initial investments. Some brokers set the bar as low as $1, while others might ask for a minimum of $10 or higher. It’s recommended to begin trading with a modest sum to realistically evaluate the broker’s services and the trading interface.

What’s the least deposit for MT4?

An MT4 account can be started with as little as $1. Though not typically recommended, it’s feasible to start trading forex with $1. However, trading with such a nominal amount limits potential earnings.

While a few brokers accommodate a $1 starting investment, most established brokers require at least $50.

Numerous esteemed forex brokers impose no minimum deposit, offering the flexibility to commence trading with any amount.

The upper limit for minimum deposits is generally around $100, influenced by the chosen payment method in the USA, like direct bank or wire transfers.

Which forex broker requires no initial deposit?

The ideal forex broker with a negligible or zero deposit often depends on an individual investor’s needs. While some don’t mandate an initial deposit, others may require $500 or more. Presently, many brokers prioritize low minimums, often under $100 or even down to $0. It’s advisable to shop around to find one that aligns with your financial capabilities.

Brokers like Oanda, Pepperstone, and XM rank among the top for minimal deposit requirements. Additionally, online brokerages such as TD Ameritrade, E-Trade, and Schwab offer various discounts and incentives.

Which broker is optimal for a low minimum deposit?

Forex brokers like CMC Markets advocate a $0.00 minimum deposit, meaning you can open a live account with any amount you’re comfortable starting with.

Here are some top brokers with minimal deposit requirements for a live FX trading account:

- CMC Markets – $0

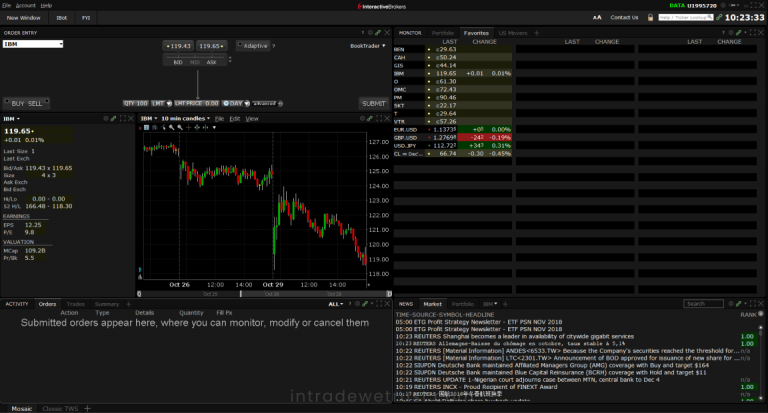

- Interactive Brokers – $0

- TD Ameritrade – $0

- XTB – $0

- OANDA – $0

Tips on starting capital

It’s important to factor in additional expenses like wire transfer fees and other transaction costs, which can vary based on your selected payment method. Also, consider the margin (collateral) you plan to use for your intended trade volumes.

Why should i consider a forex broker with a low minimum deposit?

Does a low minimum deposit affect the quality of broker services?

Can i access all trading instruments and features with a low minimum deposit?

Popular queries