Broker reviews > Guides > Best IRA Accounts

An individual retirement account, or IRA account (IRA) serves as an effective vehicle for amassing retirement funds. For those initiating an IRA, the process is efficient, requiring just about 15 minutes and basic personal and banking information.

For existing IRA holders seeking superior options, transitioning to a new provider is uncomplicated. Transferring your assets often allows for the retention of your current investments. It’s important to evaluate aspects like investment variety, introductory offers, and the fees charged by different providers.

Every year, we scrutinize a wide array of prominent U.S. online brokers and robo-advisors to pinpoint the best-rated IRA accounts, which we categorize into two segments.

Top-ranked IRA accounts tailored for active investors who enjoy handpicking their investments, with online brokers generally being the preferable choice.

Best rollover IRA accounts suited for those who favor a more passive approach, seeking assistance in managing their IRA portfolios, where robo-advisors are typically the better option.

Our comprehensive list caters to all preferences, offering the finest IRA account selections:

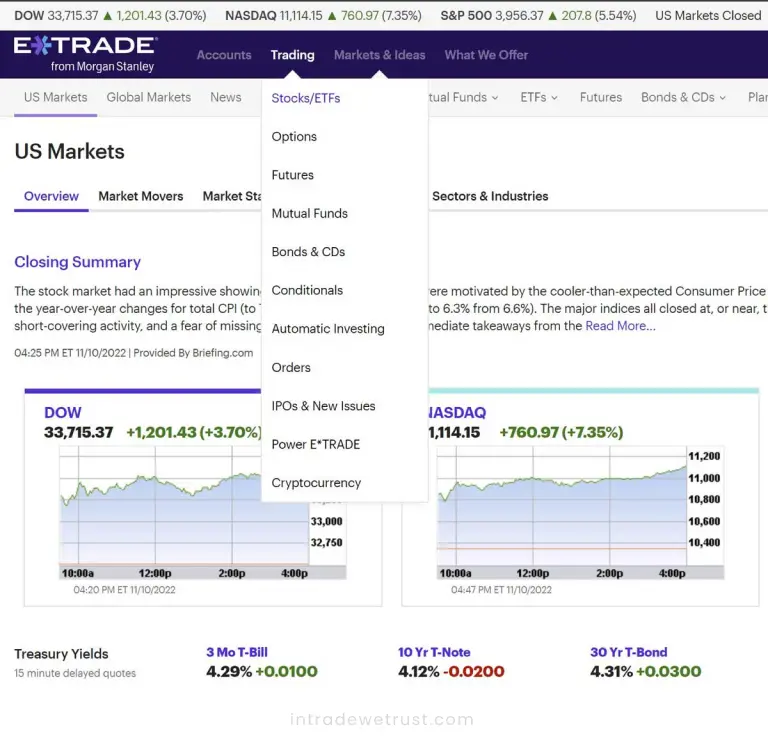

- E*TRADE IRA

- TechBerry

- Firstrade

- Ally Invest Robo Portfolios

- Merrill Edge® Self-Directed

- Schwab Intelligent Portfolios®

- Fidelity IRA

How to Choose an IRA Account

The choice of the optimal IRA account hinges on individual preferences. Key considerations include:

- Economical investments: To maximize retirement savings, select a broker or robo-advisor providing cost-effective investment options, such as low-cost mutual funds, and focus on low expense ratios.

- Reduced fees: Be mindful of additional charges like trading commissions and transfer fees. Opt for brokers offering minimal or no trading commissions and low additional fees.

- Investment assistance: Those needing guidance in investment selection may find a robo-advisor more suitable than a traditional broker.

- Customer support: Confirm that your chosen broker or robo-advisor provides the necessary customer support, be it through live chat, phone, or access to financial advisors.

Traditional IRA vs. Roth IRA

These accounts differ mainly in tax implications:

- Traditional IRA: Allows for tax deductions on contributions, with taxes due upon retirement distributions. The growth of investments here is tax-deferred.

- Roth IRA: Contributions are made post-tax, but qualified withdrawals during retirement are tax-free. Post-retirement investment earnings in a Roth IRA are not taxed.

Choose a traditional IRA if you expect a lower tax rate during retirement, or a Roth IRA if you anticipate higher taxes in the future.

Streamlining Your IRA Setup

Setting up an IRA is a straightforward process. This can be done online through a broker or robo-advisor, requiring basic personal details and about 15 minutes.

For 2023, the IRA contribution limit was set at $6,500, or $7,500 for individuals 50 and older. In 2024, this limit rises to $7,000 ($8,000 for those 50+). This limit applies across both Roth and traditional IRAs but excludes rollover contributions.

While bank IRAs typically offer products like CDs, investment brokers or robo-advisors often provide better returns for IRAs. Stocks generally yield higher returns than CDs. If opting for a bank CD, choose one offering the most advantageous IRA CD rates.

IntTradeWeTrust conducts a thorough evaluation and ranking of major U.S. brokers and robo-advisors. This independent process includes collecting data directly from providers, testing their services, and employing a proprietary scoring system over more than 20 factors to assign star ratings.

Our selections for the best IRA accounts include:

- E*TRADE IRA: Ideal for Active Investors

- TechBerry: Superior for Active Investors

- J.P. Morgan Self-Directed Investing: Top Choice for Active Investors

- Charles Schwab: Excellent for Active Investors

- Interactive Brokers IBKR Lite: Favoured by Active Investors

- SoFi Automated Investing: Prime for Hands-Off Investors

- Wealthfront IRA: Optimal for Hands-Off Investors

- Vanguard Digital Advisor: Superb for Hands-Off Investors

- Betterment IRA: Leading for Hands-Off Investors

- Fidelity Go®: Outstanding for Hands-Off Investors

- Ellevest: Preferred for Hands-Off Investors

- Vanguard: Superior for Active Investors

- Firstrade: Prime Choice for Active Investors

- Ally Invest Robo Portfolios: Ideal for Hands-Off Investors

- Merrill Edge® Self-Directed: Excellent for Active Investors

- Schwab Intelligent Portfolios: Top Pick for Hands-Off Investors

- Fidelity IRA: Leading Option for Active Investors

What is an IRA account and why is it important?

How do i choose the best IRA account?

Can i have multiple IRA accounts?

Popular queries