Broker reviews > Guides > Best Day Trading Platforms

Investors often find their options limited when looking to invest internationally. Local financial institutions generally offer access to well-known markets like the US, Canada, and select European regions. However, the best offshore brokers for day trading open up a broader array of global markets, enhancing investment diversity. Given their varying regulation levels, choosing a reputable broker is crucial. We’ll explore the advantages and drawbacks of using an offshore broker and highlight the top choices.

Understanding Offshore Brokers

It’s essential to recognize that offshore brokers are not always regulated, potentially impacting the security of deposited funds. In the event of a business closure, these funds could be irretrievably lost. It’s advisable to thoroughly review the broker’s terms, conditions, and regulatory status before commitment.

Offshore brokers offer the opportunity to purchase securities outside one’s national jurisdiction. This practice is typically legal, barring specific restrictions from your employment or national laws. However, legal protections against these brokers can be limited, emphasizing the importance of selecting a trustworthy broker. For US citizens, selecting a broker that accommodates US accounts is critical due to the complexities of American tax laws and information exchange between platforms.

Pros and Cons of Offshore Brokers

Offshore brokers present a mix of benefits and challenges:

Pros:

- Flexibility. They provide access to various international stock markets, although operating in different time zones. Offerings include stocks, fractional ownership, forex, futures, funds, options, and precious metals.

- Tax Advantages. Certain countries, like Switzerland, Singapore, and Panama, don’t tax capital gains, offering potential tax benefits, especially when registered as a business.

- Leverage. Offshore brokers often offer higher margin ratios than those available in the US.

- Privacy. Financial activities and transactions may remain confidential, not shared with the investor’s country of residence.

- Wealth Protection. In politically or economically unstable countries, offshore brokers can offer a safer haven for funds.

Cons:

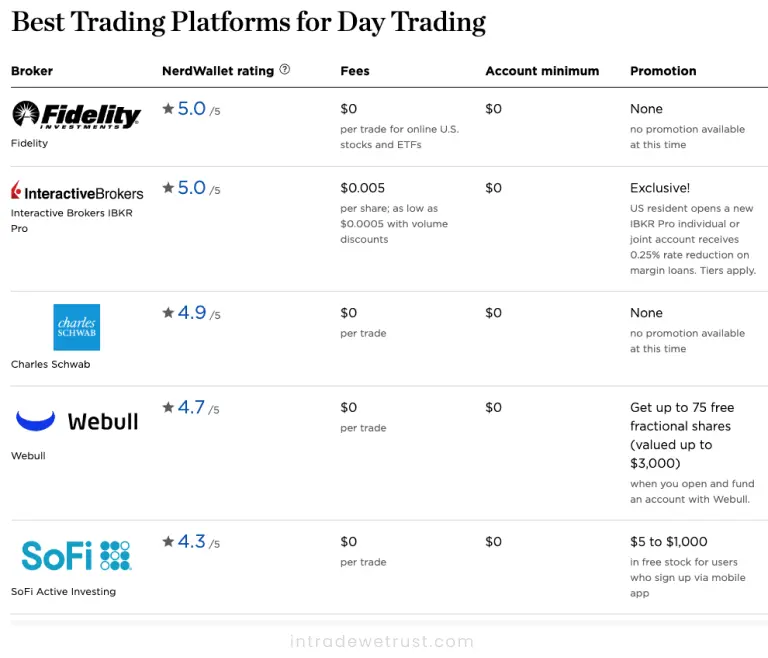

- Account Fees: Fees can vary significantly, including minimum deposits, transaction fees, and commissions.

- Risk: The potential for scams and broker insolvencies necessitates careful research and review of any offshore broker.

Key Features in Offshore Brokers

Mobile Compatibility: A robust platform for both mobile and desktop is essential.

Withdrawal Flexibility: Look for brokers that don’t restrict the frequency or amount of withdrawals.

Banking Services: Some brokers offer additional banking services like accounts, credit cards, and loans.

Customer Support: Efficient customer service is vital for resolving issues promptly.

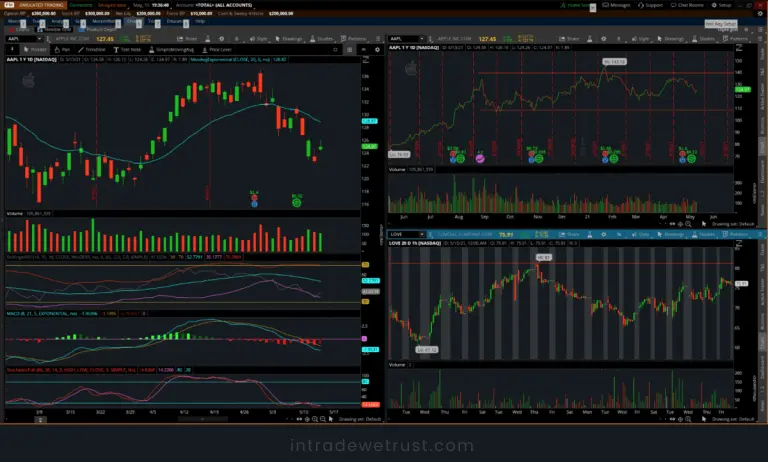

Trading Tools: Top brokers should offer real-time quotes, watchlists, charts, options, and other essential trading tools.

Choosing the Best Offshore Broker

Among the best platform to day trade options offshore, eToro stands out with its vast user base and diverse features, blending brokerage services with social media elements. It’s known for its commission-free structure and regulated environment. The platform provides access to numerous international exchanges and offers a range of investment options, including cryptocurrencies and forex.

- Plus500, another notable offshore broker, caters more to intermediate and expert traders, offering extensive features and tools for CFD trading. It’s highly regulated and available in multiple languages.

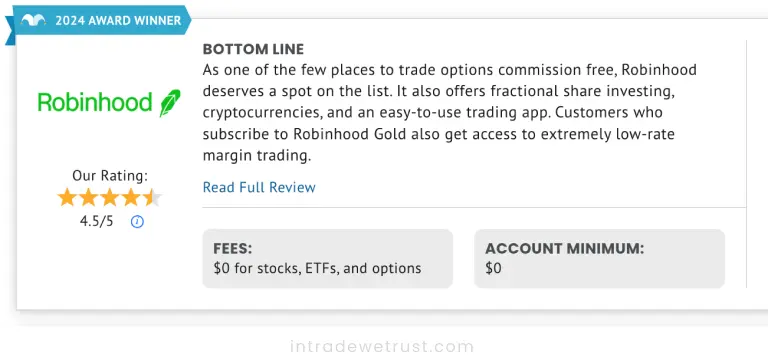

- Robinhood, despite its controversies, remains a significant player, especially for US stocks, cryptocurrencies, and ETFs. Its user-friendly platform is suitable for everyday investors, though it may be too basic for advanced traders.

- Other Notable Mentions – TD Ameritrade, Fidelity International. These platforms strive to offer competitive advantages, specializing in areas like foreign exchange or cryptocurrencies.

Conclusion

Offshore brokers are rapidly gaining popularity, offering numerous advantages over traditional domestic financial institutions. However, it’s vital to choose carefully, considering features like international market access, cryptocurrency options, and risk levels. For those keen on expanding their trading knowledge, many educational resources are available, including courses on options trading for smaller accounts.

What features are crucial for day trading platforms?

Can day trading be profitable for beginners?

How much capital do i need to start day trading?

Popular queries