Broker reviews > Reviews > Tradier review

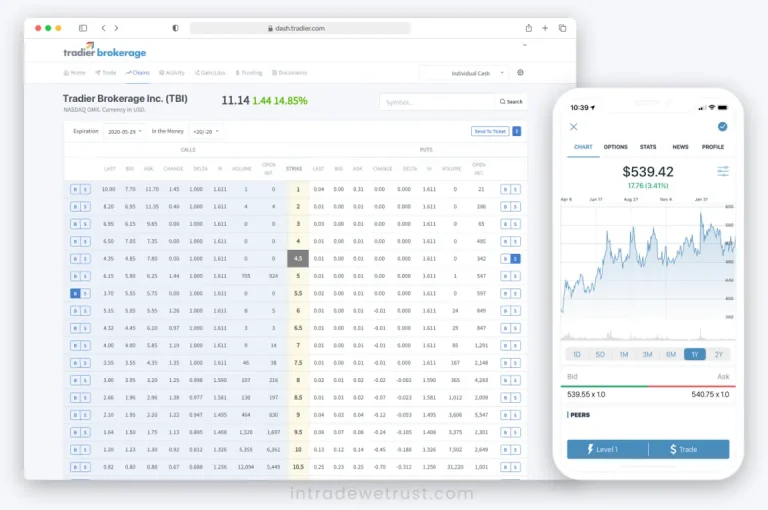

Tradier – A Customizable Platform for Seasoned Traders

Tradier stands out in the crowded online brokerage space with its fully customizable trading platform. It’s like a sandbox for traders, offering a unique mix of third-party modules that lets you piece together your own trading toolkit. For traders who know exactly what they’re aiming for, Tradier’s flexibility is a dream come true, offering a level of personalization that’s hard to find elsewhere. This might be a bit much for newcomers, but for seasoned traders, it’s like finding the perfect fit.

Cons and Pros

Pros:

- Platforms: Tradier is in a league of its own when it comes to the variety of trading platforms it offers. It’s pretty much unmatched, giving you the freedom to trade how you want, where you want.

- API Magic: Especially handy for those who manage others’ investments, Tradier gives you the tools to craft your own trading platform, automate trades, or even put your own branding on the trading process.

- Friendly Commission Rates: You’re looking at zero fees on stock orders and just $0.35 per options contract, making it easier to keep more of your profits.

- Buddy Up with TradingView: Tradier teams up with TradingView, arguably the best in the business for charting and market analysis, allowing you to make informed trades directly through Tradier without hopping between platforms.

Cons:

- Platform Fees Can Add Up: Choosing your platform might come with its own price tag, including potential fees for using TradingView brokerage services.

- High Stakes for Complex Options: If you’re into more sophisticated options strategies like selling naked puts or calls, be prepared to meet some hefty minimum investments, ranging from $10,000 to $100,000.

- Crypto’s a No-Go: If you’re looking to trade Bitcoin or Ether, you’ll need to look beyond Tradier, as it doesn’t cater to cryptocurrency trading.

- Annual IRA Fee: Planning on using an IRA? There’s a $30 annual fee to consider, which could total up to $900 over 30 years. That’s money you might prefer investing elsewhere, especially considering some brokers don’t charge for IRA maintenance.

Tradier’s Financial Stability and Security Measures

Wondering about the safety of parking your investments with Tradier Brokerage? Well, you’re in good hands. Tradier Brokerage, nestled in the US, doesn’t just operate in the wild west of online trading; it’s part of the Securities Investor Protection Corporation (SIPC) and sticks to the Financial Industry Regulatory Authority (FINRA) rules. This means they’ve got a tight ship to run, adhering to strict laws to keep your assets secure.

In the not-so-cheery event of Tradier Brokerage hitting financial troubles or declaring bankruptcy, the SIPC steps in to protect your stocks and cash up to $500,000. Remember, though, this safety net catches you from brokerage failure, not from the ups and downs of the market itself.

When it comes to the nitty-gritty of your account’s security, much depends on how you set up your platform and the tech you choose to use with Tradier. They’re pretty keen on reminding developers to beef up their platforms with all the cybersecurity essentials like firewalls and data encryption. If you’re leaning towards mobile trading, checking for features like two-factor authentication is a smart move to keep your investments snug as a bug.

All things considered, Tradier Brokerage appears to be a sturdy ship in the sea of online brokerages, guided by regulatory compasses and equipped with a financial life jacket. But, as with all sailing adventures in the investment world, the sea can get choppy, so doing your homework and making informed choices is key.

Understanding Tradier’s Revenue Streams and Account Options

You might wonder, “If trading stocks and ETFs with Tradier is free, how do they make their money?” Well, they’ve got a trick up their sleeve called Payment for Order Flow (PFOF). In simple terms, Tradier gets a little thank you payment from exchanges and other market movers for directing trades their way.

Aside from the PFOF, Tradier also earns from margin lending and some additional fees. While they don’t charge you for stock trades or options contracts, they do have a $0.35 charge per options contract. And for those who want the VIP treatment, there’s a Pro monthly membership offering unlimited free options trading among other perks.

But it’s not all about the big transactions. They also have some smaller fees for specific services, like $10 if you need a broker’s help with a trade and $9 for options exercises or assignments.

So, there you have it—Tradier keeps the platform running and the services top-notch by blending a mix of PFOF, select trading fees, and membership options, ensuring you get a smooth trading experience without the typical commission costs.

If you can trade without shelling out commissions on Tradier? Let me break it down for you. Tradier swings open the doors to two main types of accounts: Subscription, and then there’s Equity and Option. Both of these cool options let you trade stocks and ETFs without those pesky commissions that can nibble away at your profits.

But, and there’s always a but, right? If you’re eyeing those single listed stock options, the Subscription account, which costs you 10 bucks a month, does indeed offer commission-free options trading. Catch is, each option contract will tack on a $0.35 fee. No monthly fee haunts the Stock and Options account, but that $0.35 per contract fee for options trades is still lurking around.

Thinking about using margin? Tradier’s got a competitive rate of 5.25%, which is pretty solid compared to the other brokerage giants out there. They do dabble in payment for order flow, which is just a fancy way of saying they get a little thank you payment for routing trades through specific market makers. Some folks worry this might mean you’re not getting the best price on trades, so it’s something to chew on.

Diving into the extras, those third-party modules you might want to add to your Tradier toolbox can vary in cost. Some, like Exeria, won’t cost you a dime, while others, like Trader Oasis, will set you back $150 monthly. So, if you’re decking out your Tradier setup with these add-ons, keep an eye on the price tag – things can add up fast.

As for the fine print, electronic statements are on the house, and there’s no gatekeeping minimum balance to start an account. But, Tradier does have a few extra fees hidden under the couch cushions:

- Got a Tradier broker to place a trade for you? That’s $10 a pop.

- Less than two trades per year in your stock and options account? That’ll be a $50 annual inactivity fee.

- For the globe-trotters with foreign stock and option accounts, less than two trades a month invites a $20 monthly inactivity fee.

- Wiring money? $30.

- Prefer paper statements? That’s $6 each.

- Decided to shake things up with voluntary security reorganizations? There’s a $50 charge.

- Moving your account elsewhere with an automated transfer? Farewell fee of $75.

Tradier offers a pretty sweet deal on commission-free trading, but keep your eyes peeled for the other charges. It’s all about matching up what you need in a broker with what’s on offer, and sometimes, digging through some Tradier reviews can give you the inside scoop on making your choice.

What services does Tradier offer to its clients?

How does Tradier's pricing structure work?

What types of accounts can I open with Tradier?

Popular queries