Broker reviews > Reviews > Interactive Brokers checking review: Pros & Cons for 2023

Interactive Brokers – A Comprehensive Trading Platform

Interactive Brokers has caught our eye with some pretty competitive charges and margin rates, making them a solid pick for anyone looking to dive into stock trading. Here’s the lowdown on what makes them tick and a few areas where they might need to up their game.

Pros

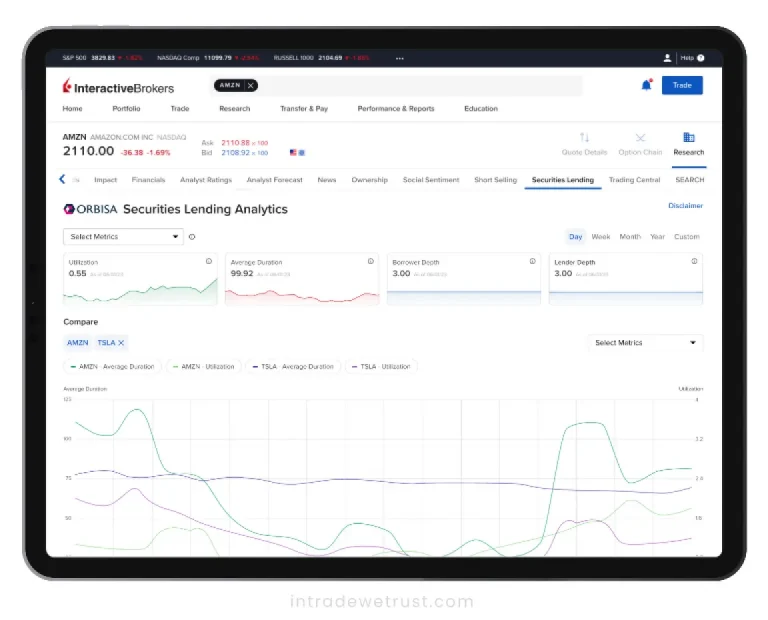

- All the Bells and Whistles: From bonds and mutual funds to the flashier stuff like cryptocurrencies and U.S. spot gold, they’re pretty much a one-stop-shop for traders.

- Low Margin Rates: Big spenders, listen up! Their margin rates are seriously low, especially if you’re playing with larger orders. We’re talking up to 50% cheaper than what you’re likely to find elsewhere.

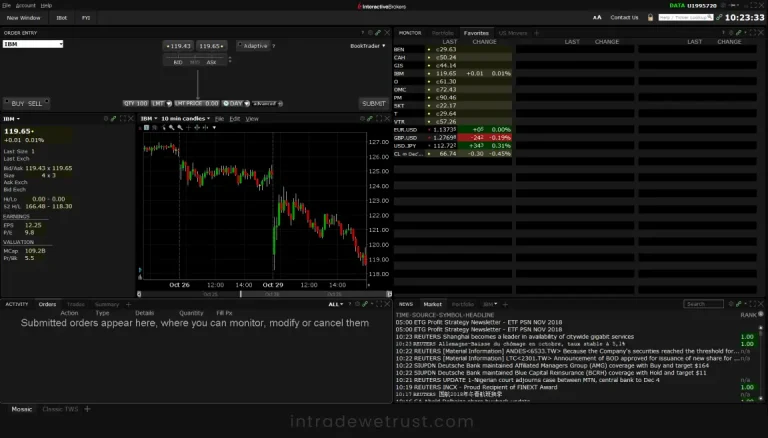

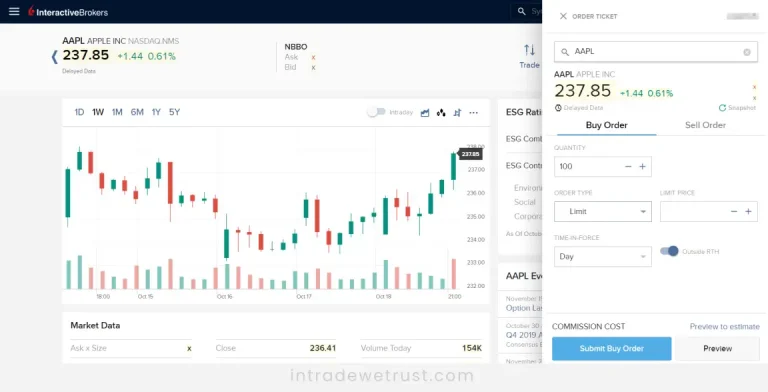

- Tech Galore: Whether you’re a fan of desktop setups or trading on the go, they’ve got an app or platform for you. Trader Workstation, IBKR Smartphone, you get the gist. They even have IBKR EventTrader for those looking to bet on specific events.

- SmartRouting Superpowers: Hate overpaying? Their SmartRouting system automatically finds the best prices for your trades.

- Global Reach: With access to markets in 33 countries and trading in 24 currencies, they’re perfect for the international trader.

Cons

- Order Flow Compensation: There’s a chance your trades might not get the best possible pricing due to how they route orders. Worth keeping an eye on.

- Navigation Nightmares: Got a sense of adventure? You might need it to navigate their vast array of services. They’re working on it, though.

- Strict Trading Permits: Getting the green light for trading certain products can feel a bit like jumping through hoops.

- Withdrawal Fees: Need to make more than one withdrawal a month? That’s going to cost you.

- Retail Investor: Designed with institutional investors in mind, the average Joe might find the platform a bit unwieldy, from the two-step login to just getting a simple stock quote.

Trustworthiness and Accessibility of Interactive Brokers

When it comes to putting your money somewhere, you want to know it’s in good hands, right? Interactive Brokers isn’t just any old brokerage firm. They’re the real deal, offering everything from executing trades to prime brokerage services, without playing favorites with their own trades.

They’re kept in line by some big names like the Commodity Futures Trading Commission (CFTC) and are registered as a Futures Commission Merchant. Plus, they’re under the watchful eyes of the Securities Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), along with a host of other regulatory bodies. So, yeah, they’re pretty legit.

What’s the Deal with Deposits at IBKR?

Remember when you needed a cool $10,000 just to start an account with IB? Those days are gone. Now, getting started doesn’t require a hefty deposit upfront. That said, what you’re planning to do with your account could change the game. Looking to dive into margin trading? You’ll need $2,000 to get going. And for the big players, a portfolio margin account will set you back $110,000.

Is Your Money Safe with IBKR?

Interactive Brokers isn’t just financially stable, they’re on solid ground with a track record to prove it. They raked in $2.0 billion in pretax profits in 2022, and their debt-to-equity ratio shows they’re not over-relying on borrowed money. That’s a big deal because it means they can weather financial storms pretty well.

They’re in a bunch of different lines of business, from brokerage services to asset management, which helps spread out any risks. Plus, being under the strict supervision of the SEC and the Financial Conduct Authority (FCA) means they’re playing by the rules to keep things above board.

With a strong capital foundation and a smart approach to risk (thanks to real-time margining), IBKR stands as a beacon of financial stability in the tumultuous world of trading.

So, Is Interactive Brokers Beginner-Friendly?

Despite its rep for complexity, a lot of reviews point out that Interactive Brokers is doing a solid job of welcoming newcomers. They’re expanding their toolkit to include more beginner-friendly options without losing sight of what makes them great for the seasoned traders. So, if you’re willing to climb the learning curve, IBKR might just be a good fit.

What are the advantages of using Interactive Brokers for trading?

How does Interactive Brokers facilitate global trading?

What are the costs associated with trading on Interactive Brokers?

Popular queries