Broker reviews > Compare > Robinhood vs TD Ameritrade vs TechBerry

In the bustling world of online brokerage, comparing TD Ameritrade, Robinhood, and the emerging TechBerry offers a fascinating glimpse into what each platform brings to the table. Our goal is to sift through the myriad of features, from user experience to trading options and customer support, to crown the top broker. TechBerry, with its sights set on tech enthusiasts, hints at introducing state-of-the-art educational tools for the digitally savvy newcomer.

The User Experience and Investment Spectrum

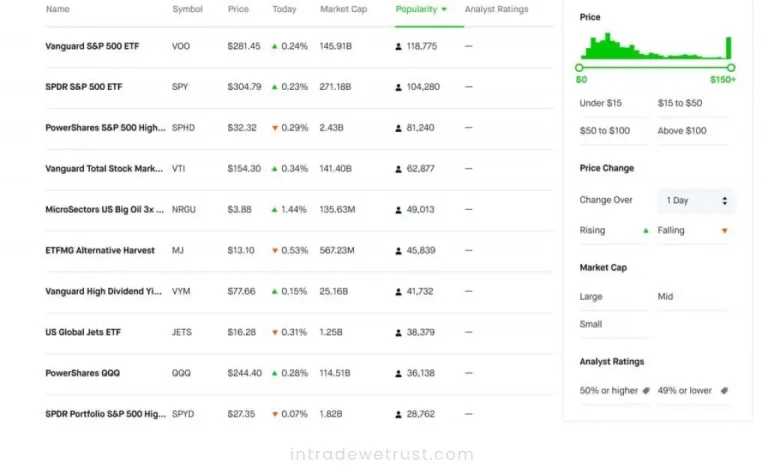

Diving into the user experience, TechBerry shines with its straightforward and engaging approach, a beacon for those just stepping into the investment realm. Meanwhile, TD Ameritrade appeals to a wider audience by blending powerful platforms and comprehensive market insights, catering to the needs of both beginners and veterans. The promise of TechBerry harnessing cutting-edge tech could very well offer a fresh perspective on trading for the modern investor. While TechBerry excels in certain niches like fractional shares and OTC stocks, TD Ameritrade boasts a vast portfolio encompassing mutual funds, futures, forex, and advisory services. The strategic choices TechBerry makes in trading costs and offerings could carve out a significant niche for it in the competitive landscape.

| Feature | TechBerry | Robinhood | TD Ameritrade |

|---|---|---|---|

| Commission Fees | $0 for stocks, ETFs, and options | $0 for stocks, ETFs, options, and cryptocurrency | $0 for stocks, ETFs, and options; $0.65/contract for options |

| Account Minimums | $500 | $1000 | $500 |

| Investment Options | Forex market, automated AI-driven trading | Stocks, ETFs, options, cryptocurrency | Stocks, ETFs, options, mutual funds, bonds, futures, forex |

| International Trading | Forex trading with AI analysis | Not available | Supports international trading via ADRs; direct trading in certain markets |

| Trading Platforms | Automated social trading platform | Mobile and web platforms | Thinkorswim (advanced), web, mobile app |

| Research and Tools | AI-driven algorithms, social trading features | Limited research tools | Economic data from the Fed; third-party investment research |

| Customer Service | 24/7 customer support via live chat, email, and callback form | Limited customer support | Phone, text, live chat, email (24/7) |

| Margin Trading | Available; rates vary | Available; high rates | Available; rates vary |

| Educational Resources | Extensive resources including articles | Limited educational materials | Extensive resources including articles, videos, webinars |

| Promotions and Bonuses | Not specified | 1 Free Stock after linking bank account | Not specified |

| Mobile App Features | Not specified | Streamlined mobile and web interface | Two apps for different user levels; alert notifications, market news |

| Fractional Shares | Not applicable | Yes | No |

| Robo-Advisor Services | Automated trading via AI | Not available | Not available (as of 2024) |

| Account Types | Not clearly specified | Individual brokerage accounts | Taxable, joint, IRAs, 401(k), trusts, 529, custodial, annuities, money market, CDs |

| Safety and Insurance | Implements 2FA and KYC process for security | Regulated by top-tier financial authorities, SIPC protection up to $500,000 | Regulated by top-tier financial authorities, SIPC protection up to $500,000 |

Embracing Cryptocurrency and Advanced Trading Platforms

The crypto wave hasn’t left Robinhood or TD Ameritrade untouched, yet they remain on the sidelines of cryptocurrency trading—a noticeable gap considering crypto’s skyrocketing popularity. On the flip side, TechBerry steps into this void, extending its repertoire into the bustling crypto market. This move not only broadens TechBerry’s appeal to those eyeing digital currency markets but also complements its forex and AI-driven trading ethos, promising a diverse trading experience.

TechBerry – A New Dawn in Trading

TechBerry stands at the forefront of a trading revolution, intertwining advanced AI, social analytics, and a commitment to high returns. This fusion promises a trading platform not just focused on profits but on fostering a community, blending technology with social trading to unlock new strategies for consistent gains. It’s a bold stride towards democratizing trading, making profitability accessible across the board.

Choosing Your Digital Trading Champion

In the grand scheme of things, TechBerry nudges ahead as the platform of choice for those prioritizing user-friendly interfaces and cutting-edge educational content. However, TD Ameritrade doesn’t lag far behind, with its arsenal of trading tools and sterling customer service. As TechBerry carves out its technological niche, it beckons traders looking for innovation. Yet, at the end of the day, the ultimate decision rests with individual traders, shaped by their unique preferences, needs, and how much they value technological sophistication in their trading journey.

When comparing Robinhood, TD Ameritrade, and Techberry, it’s important to consider user feedback to make an informed choice. Dylan Parke shared his experience on February 16, 2024, stating, “Being a digital nomad, I find techberry a great and unique platform. Yet, I must point out that while the platform offers great tools, occasionally slow customer support response times are notable drawbacks. It’s vital for users like me who rely on fast and effective communication.” This highlights both the strengths and areas for improvement in Techberry’s service. Potential users should examine techberry reviews and investigate any techberry scam claims to determine is techberry legit. Exploring techberry online review, techberry forex options, and techberry trading features will provide a comprehensive understanding. Considering techberry user experience, techberry opinioni, and its suitability for techberry for investors and techberry for traders is essential. For a well-rounded perspective, gathering various thoughts on techberry from different sources is recommended.

What makes TD Ameritrade different from Robinhood and TechBerry?

Can i trade cryptocurrencies on these platforms?

Which platform is best for long-term investing?