Broker reviews > Reviews > Assessing the positives and negatives of Charles Schwab

Exploring the realm of Charles Schwab offers an insightful glimpse into a brokerage that’s more like a financial ecosystem, evolving continuously to meet the diverse needs of its clientele. From its strategic expansions and acquisitions, including the notable addition of TD Ameritrade, to a suite of innovative products and tools, Schwab has cemented its position in the investment world, catering to everyone from the novice to the seasoned investor.

Overview of Charles Schwab’s Financial Ecosystem

Pros

-

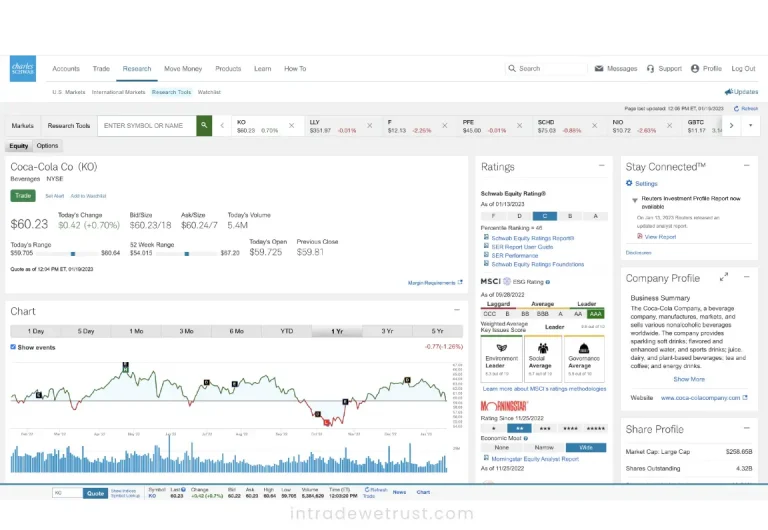

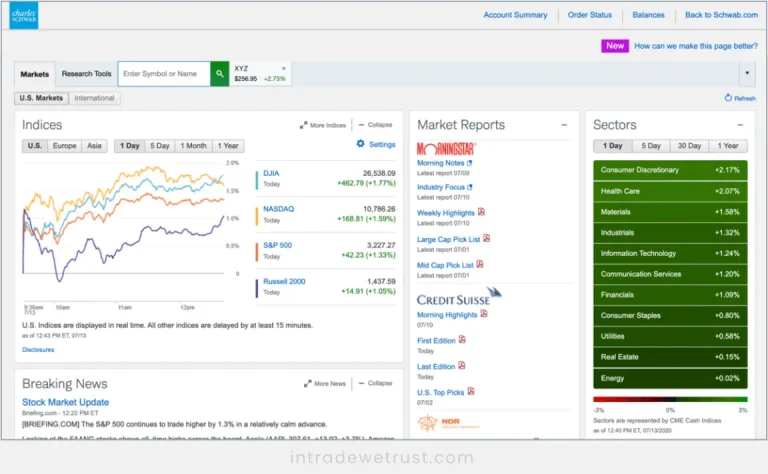

A varied array of platforms caters to a broad spectrum of investor needs, from beginners to pros.

-

Exceptional ETF scanners and research tools stand out, making it easier to sift through investment options.

-

The allure of commission-free trades in stocks and ETFs can’t be overstated, offering significant savings over time.

-

Forward-thinking features like AI and robo-advisors provide a modernized investing experience.

-

The availability of ESG ETFs for socially responsible investing is a commendable addition.

Cons

-

Higher margin rates may deter those looking to leverage their investments.

-

The lack of an automatic sweep feature means cash might not be as efficiently managed as it could be.

-

Investors interested in ETF trading with fractional shares might find limitations here.

-

The absence of direct cryptocurrency investments might disappoint crypto enthusiasts.

Making the Decision – Is Charles Schwab the Right Fit for You?

Deciding if Charles Schwab is your financial ally depends on various factors, each personal and unique to your financial journey.

Consider these elements:

- Financial Goals: Identifying what you’re investing for—be it retirement, a new home, or your child’s education—is pivotal. Schwab offers resources to help you reach these milestones, yet ensuring their offerings align with your goals is essential.

- Investment Savvy: Your experience level can significantly influence your choice. Schwab caters to all, from offering robo-advisors like Schwab Intelligent Portfolios for beginners to providing self-directed accounts for the more experienced.

- Investment Capital: Your budget for investment plays a crucial role. Schwab’s diverse account options mean you can likely find a fit that suits your financial situation.

Account Options and Wealth Management at Charles Schwab

Embarking on an investment journey with Charles Schwab opens up a realm of possibilities, tailored to cater to a wide range of financial goals and investment strategies. What makes Schwab particularly inviting is its flexible approach to account minimums, designed to accommodate investors at every stage of their financial journey.

- Self-Directed Accounts: For those looking to dive straight into investing without a preset course, Schwab’s self-directed accounts require no minimum balance, making it an accessible entry point for many.

- Robo Accounts and Advisory Services: Robo Accounts with a $5,000 minimum and human advisor options for a more personalized investment approach.

- Premium Financial Planning and Wealth Management Services: Offering customized plans, traditional and independently managed accounts with varying minimum investments tailored to cater to a sophisticated clientele.

What tools and resources does Charles Schwab offer to investors?

How can I open an account with Charles Schwab and what are the requirements?

What are Charles Schwab's fees for trading and investment services?

Popular queries