Broker reviews > Reviews > Interactive Fidelity checking review: Pros & Cons for 2023

Overview of Fidelity’s Cash Management Account

Fidelity Investments isn’t just any financial heavyweight, it’s a giant, with its Cash Management

Account standing tall among the giants of asset management worldwide. Though primarily a brokerage account, it moonlights as a checking account, complete with the usual bells and whistles, and even sports enhanced FDIC insurance coverage to boot.

Pros

- No need to worry about minimum balances here.

Say goodbye to those pesky monthly fees. - ATM fees? Fidelity’s got them covered across the US.

- They throw in a debit card and a checkbook for good measure.

- Up to $1.25 million in FDIC insurance? Yes, please.

Cons

- Physical branches are few and far between.

- Interest rates are hanging out at the bottom of the barrel.

Safety and Security with Fidelity Investments

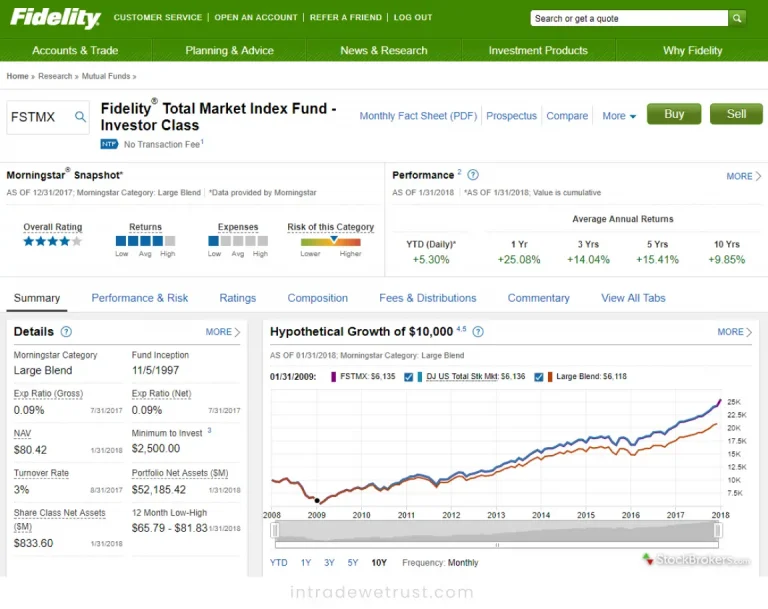

Fidelity is a titan in the financial world, having set up shop in the US since 1946. It’s watched over by the SEC and FINRA, so you know it’s legit. Free stock and ETF trades, a treasure trove of no-expense-ratio index mutual funds for both rookies and veterans, and a top-notch web trading platform are just the start.

Why Your Money’s Safe with Fidelity:

Two-factor authentication is a must, whether you’re making a high-risk transaction or just logging in.

Biometric login for mobile app users? Check.

Security questions for unfamiliar browser logins? You bet.

Fidelity’s extra SIPC insurance goes up to $1.9 million for uninvested cash, leading the pack in the brokerage world.

The Fidelity Customer Protection Guarantee is your shield against unauthorized activity in your accounts.

Platform reliability is strong, with no widespread or significant failures to report.

Is Fidelity good for beginners?

Fidelity is a fantastic choice for novice investors because it provides various financial products and information. Fidelity Customized Planning and Advisors will create and handle your investment if you’re new to investing but don’t want to make trades through self-directed accounts. Fidelity also provides advice from human advisors. Fidelity Customized Planning & Help, Fidelity Wealth, and Private Management offer help at a higher price. The fidelity full view review provides all investing account services that beginners use. Last but not least, Fidelity Viewpoints provides a selection of investment education and market analysis books. This might be another fantastic resource for those who want to increase their confidence when investing.

Does Fidelity have hidden fees?

Fidelity is renowned for low trading costs, commission-free ETFs, and mutual funds. Investors need to be aware of the several expenses it does have. The complete list of Fidelity’s hidden fees, including services and margin charges that investors should know about, is provided below. Expense ratios, account fees, trading costs, fees for outbound domestic wire transactions, and margin interest are key considerations for investors at Fidelity.

Want to keep more of your money instead of paying fees? Here’s how to sidestep some of the sneaky costs at Fidelity: Pick Low-Cost Funds, Give Margin Accounts a Wide Berth, Stay Informed, and Keep an Eye on Your Account.

Active Trader Pro – Your Trading Wingman

Ever wished for a trading buddy who’s got your back 24/7? Meet Active Trader Pro. It’s like having a dashboard for your investments, complete with real-time data, trading tools, and even a snapshot page that shows how your investments are doing on the social, environmental, and governance front. Catch the Wave with Real-Time Analytics, Strategize Like a Pro with Trade Armor, and Stay on the Pulse with the Daily Dashboard. What’s the Deal with Active Trader Pro? It’s free for all Fidelity customers, offering a competitive edge with no additional cost.

What investment products does Fidelity offer?

How does Fidelity support investor education?

Are there any fees for trading with Fidelity?

Popular queries