Broker reviews > Compare > TradeStation vs Interactive Brokers vs TechBerry

TradeStation – The Technical Trader’s Toolkit

TradeStation has long been the go-to for active traders and professionals who demand a robust platform backed by powerful analytical tools. Known for its $500 commission trades on stocks and ETFs and a competitive tiered pricing model for options and futures, TradeStation offers something for everyone. Its real allure lies in the platform’s customization capabilities, top-notch charting, and a diverse array of tradable securities, including the ever-popular cryptocurrencies. Ideal for the technical trader, TradeStation provides detailed analysis and swift execution, making it a powerhouse for those who rely on technical analysis.

Each of these platforms caters to different types of investors and traders, from beginners to seasoned professionals, and offers unique tools and services. TradeStation is renowned for its powerful trading tools and robust platform, Interactive Brokers stands out for its global reach and low-cost structure, and TechBerry emerges as a tech-forward broker integrating cutting-edge technologies like AI into trading.

This article aims to dissect and compare the key features of these brokers — from commission fees and trading conditions to the unique advantages each offers. Whether you’re an active trader seeking advanced charting tools or a passive investor looking for automated strategies, understanding the nuances of TradeStation, Interactive Brokers, and TechBerry will equip you with the knowledge to make an informed decision. Let’s dive into the world of online trading and unravel what each of these brokers has to offer.

- TradeStation: TradeStation is a favorite among active traders and professionals, known for its comprehensive trading platform and powerful analytical tools. It offers $500 commission trades on stocks and ETFs, with a tiered pricing structure for options and futures. The platform stands out for its customization options, advanced charting, and a wide range of tradable securities including cryptocurrencies. TradeStation is ideal for technical traders who require detailed analysis and fast execution.

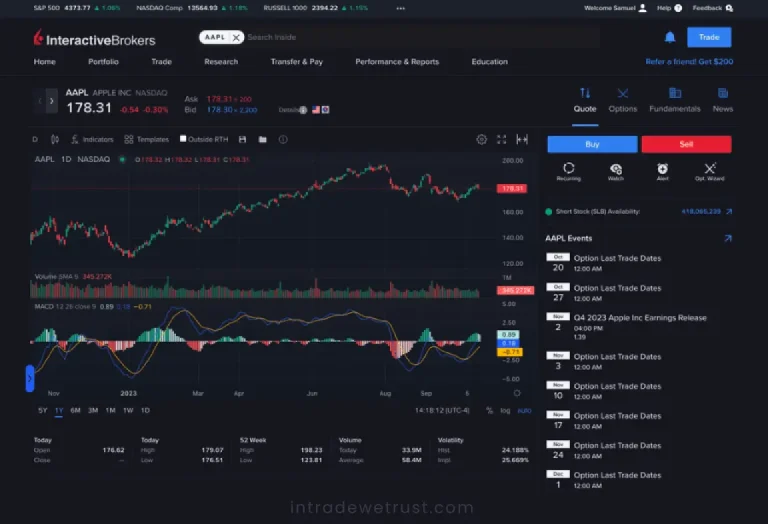

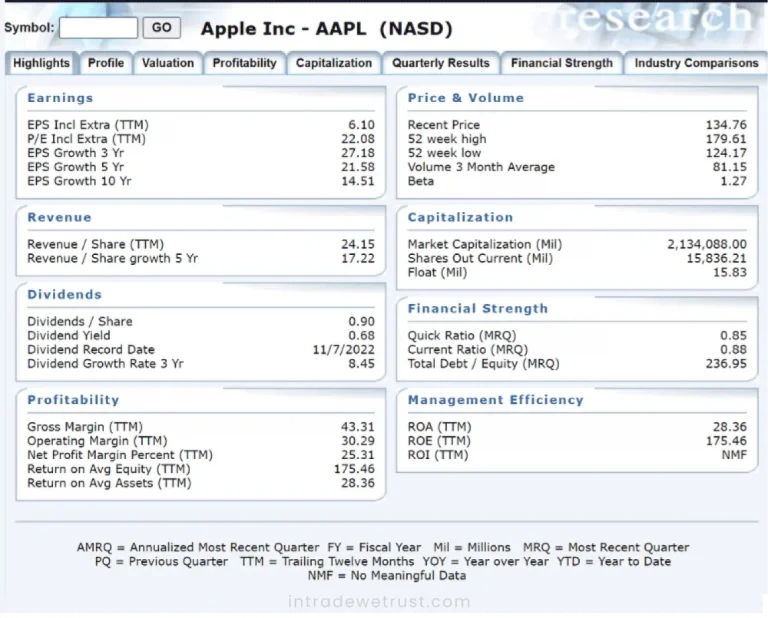

- Interactive Brokers (IBKR): Interactive Brokers is renowned for its extensive global reach, offering access to over 135 markets in 33 countries. It’s a top choice for serious traders due to its competitive commission rates, especially for high-volume trading. IBKR’s platform, Trader Workstation, is feature-rich and suitable for professional traders. It also offers a vast array of investment products, low margin rates, and robust research tools, making it well-suited for advanced traders and investors seeking international exposure.

- TechBerry: TechBerry stands out as a technology-driven online broker, focusing on innovative solutions like AI-driven portfolio management and social trading. While details about its fee structure are not as widely known, it is presumed to offer competitive rates, appealing to cost-conscious traders. TechBerry’s platform is likely user-friendly and integrates advanced technologies, making it attractive for a new generation of traders. Its unique selling point is the use of AI and machine learning to provide market insights and trading strategies.

Interactive Brokers – A Gateway to Global Markets

Interactive Brokers (IBKR) shines with its unparalleled global reach, allowing access to over 135 markets across 33 countries. It stands as the preferred choice for serious traders, thanks to its low commission rates—particularly beneficial for high-volume trades. The Trader Workstation, IBKR’s flagship platform, is packed with features designed for the professional trader. Beyond its extensive market access, IBKR also impresses with a broad spectrum of investment products, minimal margin rates, and comprehensive research tools. For the advanced trader or investor eyeing international exposure, IBKR is a compelling option.

TechBerry – The Future of Trading with AI

TechBerry represents the new frontier in online brokerage, with a keen focus on integrating artificial intelligence and machine learning into the trading experience. Although specific details about its fee structure are less documented, it’s understood to offer competitive rates that attract a cost-aware audience. The platform is not only user-friendly but also pioneers the use of AI to deliver market insights and trading strategies. What sets TechBerry apart is its innovative approach to portfolio management and social trading, empowered by advanced technologies that appeal to the modern trader looking for a fresh, technology-driven trading environment.

| Feature | TradeStation | Interactive Brokers | TechBerry |

|---|---|---|---|

| Commission Fees | Low fees, tiered pricing model for higher volumes | $500 on stocks and ETFs; tiered for options and futures | Commission-free or low fee structure, varies by account |

| Trading Conditions | Powerful platforms, wide range of products including crypto | Access to 135 markets in 33 countries, comprehensive product range | AI-driven portfolio management, automated trading, advanced analytics |

| Advantages | Advanced charting and analysis tools, ideal for technical traders | Global trading opportunities, excellent research tools | Integration of advanced technology, AI-driven strategies |

Which Broker Fits Your Trading Style?

While TradeStation appeals to those who value sophisticated tools and advanced charting capabilities, and Interactive Brokers offers a passport to the world’s markets with its low fees, TechBerry is carving out a niche for those drawn to innovative, tech-forward trading solutions. The decision between these brokers will ultimately hinge on your specific trading needs, whether you prioritize technical analysis, global accessibility, or the latest in trading technology. Each broker presents a compelling argument, but the right choice will depend on the alignment of their offerings with your personal trading philosophy and goals.

When comparing TradeStation, Interactive Brokers, and Techberry, it’s important to consider user feedback and experiences. Riley Marshall shared their positive experience with Techberry on April 22, 2024, stating, “I have both, USD and crypto plans and I’m really excited how fast I can withdraw in BTC – it makes managing my money so easy.” This highlights the platform’s efficiency in handling both traditional and cryptocurrency transactions. However, potential users should explore techberry reviews and investigate any techberry scam claims to determine is techberry legit. Evaluating techberry online review, techberry forex options, and techberry trading features provides a comprehensive understanding. Considering techberry user experience, techberry opinioni, and techberry for investors and traders can help in making an informed decision. For those seeking insights, gathering thoughts on techberry from various sources is recommended.

What distinguishes TradeStation, Interactive Brokers and TechBerry from each other?

Which platform is best for accessing international markets?

How do the platforms compare in terms of trading costs?