Broker reviews > Reviews > Webull review

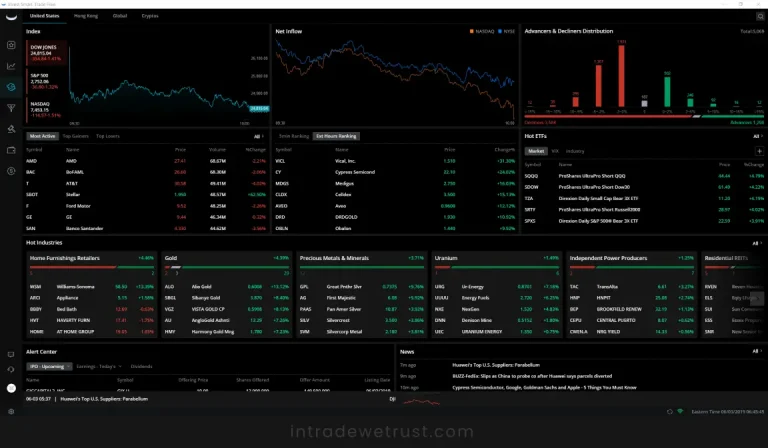

Webull stands out as a trading platform with a unique community vibe. Its slick mobile app is all about making trading approachable for beginners, allowing them to dive straight into the action. That said, if you’re looking to deepen your trading knowledge, Webull might leave you wanting more due to its limited educational content and so-so customer support. And for the more experienced traders out there, the absence of certain asset classes might make Webull feel a bit restrictive.

Wondering about Webull’s safety and credibility? Let’s break it down. Webull wraps its online activities in 128-bit encryption, putting a sturdy lock on your data. Plus, with additional security measures and two-step verification for its users, it’s built a fortress around your financial dealings. Webull isn’t just playing it safe on its own; it’s part of a network of financial bodies ensuring it sticks to the straight and narrow, safeguarding client funds along the way.

So, for anyone asking, “Is Webull legit?”—absolutely. With oversight from big names like the SEC, FINRA, and SIPC, your investments are not just protected; they’re under a financial safety net in case of company hiccups. Plus, it’s more than just a secure platform; it’s user-friendly and streamlined for trading, making it a solid choice for getting your investment journey started.

Webull has carved out a niche for itself as a platform that doesn’t shy away from diversifying its revenue streams. Here’s a quick dive into how it keeps the financial wheels turning:

- Payments for Order Flow: This is a biggie for Webull. When you place a trade, it’s handed off to market makers, who are like the wholesalers of securities. They pay Webull for the flow of these orders, earning their keep through the bid-ask spread – the difference between what buyers are willing to pay and what sellers are asking. Webull gets a slice of the action based on the volume of stocks ping-ponging between accounts.

- Subscriptions: For the trading enthusiasts who crave deeper market insights, Webull offers a NASDAQ TotalView subscription. It’s a treasure trove of data, including Level 2 quotes and the net order imbalance indicator. While the first month is on the house for newbies, it’s $1.99 a month after that. Webull flips NASDAQ a fee for access but makes a tidy sum by marking up the cost to users.

- Short Seller Financing: Webull lends stocks to short sellers, who then pay interest on these borrowed shares. This game requires a margin account and a bet that the stock’s price will tumble. Short sellers sell high, aim to buy back low, and settle their debt to Webull, interest included.

- Interest on Free Credit Balances: The free credit balance is what traders have left to play with after accounting for trades and margins. Webull doesn’t pay interest on these funds. Instead, it lends this money to banking partners at interest, turning a profit on the cash in your account.

- Margin Interest: For those venturing into margin trading, Webull offers the ability to amplify your buying power, with the catch being an interest rate on the borrowed money. The rates vary by how much you borrow, with annual rates starting at 6.99% for smaller accounts.

Can You Dive into Forex with Webull?

Ready to trade currency pairs like EUR/USD or GBP/USD? Webull has you covered. Once your account’s funded, take your pick from a selection of forex trading pairs available on the Webull app or website. The platform’s set up to make forex trading accessible, whether you’re a seasoned trader or new to the game.

In essence, Webull is a bit like a Swiss Army knife for traders, offering a range of tools and services that cater to various aspects of the trading world. Whether you’re here for the stocks, ETFs, or the allure of forex, Webull lays out a comprehensive, user-friendly experience. Just remember, every investment platform has its quirks and features, so it’s wise to tread carefully and make informed decisions.

Want to get in on short selling with Webull? It’s a strategy that lets traders bet against a stock they believe is headed for a price drop. However, navigating the waters of short selling comes with its own set of rules and a bit of a learning curve. Here’s a quick guide to shorting a stock on Webull and diving into crypto trading on the platform.

Short Selling on Webull

Before you can start betting against those stocks, you’ll need:

- A Webull margin account that lets you borrow money for your trades.

- At least $2,000 in your account, just to stay on the safe side.

Ready to short sell? Follow these steps:

- Fire up your Webull desktop app or mobile app.

- Hit up your “Watchlist” or scout for stocks on Webull’s “easy to borrow” list for short selling opportunities.

- Look for a tiny blue arrow pointing downward on the stock’s page—that’s your go-ahead.

- Tap that blue arrow if it’s there.

- Voila, you’re short selling.

- Check out “My Positions,” and you’ll see a negative number that shows you’re in a short position.

Trading Crypto on Webull

Ready for the crypto wave? Here’s how to get started:

- Sign Up: If you’re new to Webull, you’ll need to create an account first. Just like any financial platform, you’ll have to share some details and follow SEC guidelines.

- Get Authorized: To trade crypto, you need Webull’s nod. Make sure your app’s up to date, then:

Tap the Webull icon smack in the middle at the bottom.

Hit the ‘More’ button.

Choose “Crypto Trading” to send off your request.

- Fund Your Account: You can use electronic transfers from your bank or wire transfers to add money to your account. Electronic transfers are free but can take a few days. Wire transfers are faster but come with fees.

- Pick Your Crypto: Funded your account? Head to “market,” then tap cryptocurrency. You can use market orders to buy at the current price or limit orders to set your price.

- Monitor Your Crypto: With Webull, you can keep an eye on your crypto picks, set alerts for price changes, and even compare two currencies for analysis.

While Webull makes trading accessible, remember, storing a significant chunk of your crypto holdings on any exchange has its risks. For more flexibility and control, especially with larger amounts, you might consider a dedicated crypto exchange like Coinbase.

Whether you’re dipping your toes into short selling or diving into the crypto pool, Webull offers a streamlined path to explore the financial markets. Just remember, with any investment, there’s always a learning curve and risks involved.

What features does Webull offer to traders?

Is Webull suitable for beginner traders?

Are there any costs associated with using Webull?

Popular queries