Broker reviews > Compare > Fidelity vs TD Ameritrade vs TechBerry

In the ever-evolving world of online brokerage, pitting Fidelity against TD Ameritrade and TechBerry unveils a fascinating comparison of their services. Through our annual deep-dive analysis, we meticulously test their platforms, mobile apps, trading instruments, and the overall ease of use, not to mention their fee structures. Our mission? To discern which broker reigns supreme in the competitive landscape of Fidelity vs TD Ameritrade vs TechBerry.

Investment Choices and Tech-Savvy Solutions

In the realm of investment options, Fidelity steals the spotlight with its expansive portfolio, offering a more extensive selection of stock trading options and advisory services than TD Ameritrade. TechBerry, however, carves out its niche with a tech-forward approach, catering to the digitally savvy investor with an eye for innovative investment strategies. While traditional brokers like Fidelity and TD Ameritrade shy away from the unpredictable cryptocurrency market, TechBerry seems poised to dip its toes into tech-oriented solutions, possibly embracing crypto trading to woo the modern investor.

User Experience and Market Innovation

User experience is where the rubber meets the road. Fidelity takes the lead with an exemplary platform that’s a haven for day traders, thanks to its arsenal of trading tools and features. TD Ameritrade, bolstered by its merger with Charles Schwab, is no slouch either, showcasing impressive capabilities. Meanwhile, TechBerry might just be the dark horse, blending advanced technology to potentially offer a trading experience that’s heavy on automation and AI, aiming to redefine convenience for the tech-savvy trader.

| Feature | TechBerry | Fidelity | TD Ameritrade |

|---|---|---|---|

| Commission Fees | $0 for stocks, ETFs, and options | $0 for U.S. stocks and ETFs | $0 for stocks, ETFs, and options |

| Account Minimums | $500 | $1000 | $500 |

| Investment Options | Forex market, automated AI-driven trading | Stocks, ETFs, mutual funds, options, cryptocurrency, bonds, CDs, international investments | Stocks, ETFs, options, mutual funds, bonds, futures, forex, cryptocurrencies (via ETFs, mutual funds, Bitcoin futures) |

| International Trading | Forex trading with AI analysis | Charges vary by country; high fees for non-US stocks | Supports international trading via ADRs; direct trading in certain markets |

| Trading Platforms | Automated social trading platform | Active Trader Pro, web, mobile app | Thinkorswim (advanced), web, mobile app |

| Research and Tools | AI-driven algorithms, social trading features | Extensive research from third-party firms; detailed investment research on over 4,500 stocks | Economic data from the Fed; third-party investment research from Morningstar, Dow Jones, etc. |

| Customer Service | 24/7 customer support via live chat, email, and callback form | Highly rated, various contact options | Phone, text, live chat, email (24/7) |

| Margin Trading | Available; rates vary | Available; rates vary | Available; margin rate starts at 11.25% |

| Educational Resources | Extensive resources including articles | Comprehensive educational materials | Extensive resources including articles, videos, webinars |

| Promotions and Bonuses | Not specified | No current promotions (2024) | Not specified |

| Mobile App Features | Not specified | Advanced features, real-time quotes | Two apps for different user levels; alert notifications, market news |

| Fractional Shares | Not applicable | Yes, investments as low as $1 | No fractional share investing |

| Robo-Advisor Services | Automated trading via AI | Fidelity Go, competitive rates | Not available (as of 2024) |

| Account Types | Not clearly specified | Wide range including IRA, 401(k), brokerage, HSA | Taxable, joint, IRAs, 401(k), trusts, 529, custodial, annuities, money market, CDs |

| Safety and Insurance | Implements 2FA and KYC process for security | High level of security; FDIC-insured options available | Implements 2FA and KYC process for security |

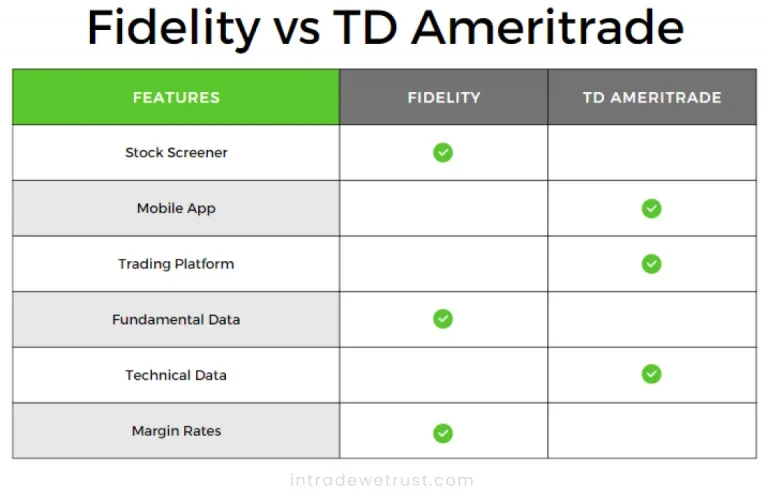

Fidelity’s mobile app, praised for its efficiency and breadth of features, outshines TD Ameritrade’s offering. TechBerry, on the other hand, is expected to play its cards by leveraging modern app design trends, possibly focusing on creating an intuitive user interface that resonates with forward-thinking traders. When it comes to market research, Fidelity takes the cake, providing richer insights and third-party research reports compared to TD Ameritrade. TechBerry could disrupt this space with cutting-edge research tools and data analytics, appealing to data-driven decision-makers.

Choosing Your Trading Ally

Accessibility and favorable trading conditions are crucial in choosing your brokerage companion. Fidelity and TD Ameritrade level the playing field with no minimum deposit requirements, welcoming traders across the spectrum. However, Fidelity’s lower margin rates could be a game-changer for margin traders, offering a slight edge over TD Ameritrade. TechBerry’s stance on margin trading and its policies could significantly impact its attractiveness to investors looking to leverage their capital.

Neither Fidelity nor TD Ameritrade currently entertain fractional shares trading, yet both support penny stock ventures, with Fidelity being the more cost-effective option. TechBerry’s approach to fractional shares and penny stocks could potentially carve a niche for itself, especially among traders targeting specific market niches. Additionally, the integration of banking services by TechBerry could serve as a cherry on top, especially if seamlessly integrated with its trading platform.

A Technological Twist in Brokerage

Fidelity emerges as a strong contender in this brokerage trifecta, with TD Ameritrade close on its heels. Yet, it’s TechBerry’s entrance that injects a dose of technological innovation into the mix, potentially attracting a distinct segment of investors. Ultimately, the decision boils down to personal investment goals, preferences, and the weightage one places on technological advancements in their trading journey.

User feedback can be particularly insightful when evaluating platforms like Fidelity, TD Ameritrade, and Techberry. Jordan Mitchell shared his experience on March 2, 2024, stating, “As my silver membership nears expiration in a few weeks, I’m considering an upgrade. What’s great about this platform, unlike others, is that it doesn’t demand my constant presence at the computer. I prefer having more time for my main job than being involved in routine process. Quick question about withdrawing funds – has anyone withdrawn in crypto with a USD membership? How fast is this method?” This review highlights Techberry’s user-friendly nature and flexibility, making it suitable for those who cannot constantly monitor their investments. However, potential users should delve into techberry reviews and investigate any techberry scam claims to determine is techberry legit. Exploring techberry online review, techberry forex capabilities, and techberry trading features will provide a comprehensive understanding. Considering techberry user experience, techberry opinioni, and its suitability for techberry for investors and techberry for traders is crucial. Gathering various thoughts on techberry from different sources can help form a well-rounded perspective.

What are the main differences between Fidelity, TD Ameritrade and TechBerry?

Which platform is best for beginners?

How do these platforms compare in terms of fees?