Broker reviews > Trading > How to Choose the Best Scalping Broker in 2024

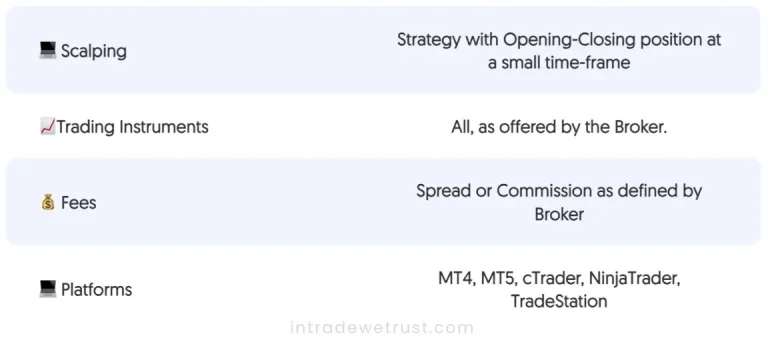

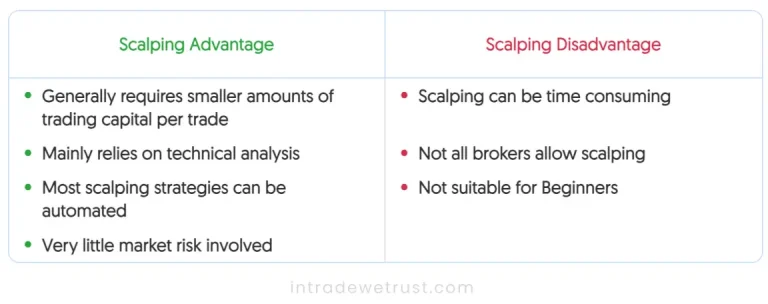

Scalping is a short-term trading strategy that involves opening and closing trades within minutes or even seconds. It can be a profitable trading style, but it also carries a high level of risk.

If you’re considering scalping, it’s important to choose the right broker. The right broker can help you to minimize your risk and maximize your profits.

Here are some tips on how to choose the best broker for scalping in 2024:

Consider your trading goals

Before you start looking for a broker, you need to consider your trading goals. What are you trying to achieve by scalping? Are you looking to make a quick profit, or are you looking to build a long-term portfolio?

Once you know your goals, you can start to narrow down your search to brokers that are aligned with your objectives.

Look for a regulated broker

Regulation is important for any type of trading, but it’s especially important for scalping. Scalping involves a high level of risk, so it’s important to choose a broker that is regulated by a reputable financial authority.

Compare spreads and commissions

Spreads and commissions are the fees that you’ll pay to the broker for each trade that you make. Scalping involves making a lot of trades, so it’s important to compare spreads and commissions before you choose a broker.

Look for a broker with a good trading platform

The trading platform is the software that you’ll use to place trades and manage your account. It’s important to choose a platform that is easy to use and understand, and that offers the features you need to scalp effectively.

Consider the broker’s customer support

Scalping can be a fast-paced and stressful trading style. It’s important to choose a broker with good customer support that is available to help you when you need it.

Table of Key Factors to Consider When Choosing a best broker for scalping

| Factor | Description |

| Trading goals | What are you trying to achieve by scalping? |

| Regulation | Look for a broker that is regulated by a reputable financial authority. |

| Spreads and commissions | Compare spreads and commissions before you choose a broker. |

| Trading platform | Choose a platform that is easy to use and understand. |

| Customer support | Choose a broker with good customer support. |

Additional tips

- Start with a small amount of money

When you’re first starting out with scalping, it’s a good idea to start with a small amount of money. This will help you to limit your losses if something goes wrong.

- Be patient

It takes time to learn how to scalp effectively. Don’t expect to become a millionaire overnight.

- Do your own research

Even if you’re following a scalping strategy, it’s important to do your own research before you make any trades. This will help you to make informed decisions and reduce your risk.

By following these tips, you can increase your chances of finding the best scalping broker in 2024.

Here are some additional factors that you may want to consider when choosing a scalping broker:

- The broker’s liquidity

Liquidity is the amount of trading activity that is available on a particular market. Scalping is a high-volume trading style, so it’s important to choose a broker that has good liquidity.

- The broker’s leverage

Leverage is a tool that can magnify your profits or losses. Scalping can be a risky trading style, so it’s important to use leverage carefully.

- The broker’s educational resources

Scalping can be a complex trading style. It’s important to choose a broker that offers educational resources to help you learn how to scalp effectively.

Choosing the best scalping broker in 2024 involves careful consideration of various factors to ensure optimal trading conditions for this specific strategy. Here’s a detailed analysis:

- Trading Conditions:

Scalping brokers must offer conditions conducive to the high-speed nature of scalping. This includes low spreads, fast execution speeds, minimal slippage, and flexible lot sizes. Brokers with tight spreads for major currency pairs and fast trade execution are crucial for scalpers to capitalize on short-term market fluctuations.

- Platform and Tools:

The trading platform is vital for efficient scalping. MT4 and MT5 are popular choices for their user-friendly tools, including colored technical indicators, Expert Advisors, and MarketWatch. Features like one-click trading and a variety of stop order types are beneficial. Some brokers also offer proprietary platforms or support for popular third-party platforms.

- Tradable Instruments:

A wide variety of tradable instruments, including forex pairs, stocks, indices, and commodities, provide more opportunities for scalpers. Brokers like FP Markets and Pepperstone offer an extensive range of instruments, which is advantageous for diversifying scalping strategies.

- Account Types and Minimum Deposits:

Brokers offer different account types, each with specific features suitable for scalping. The minimum deposit requirements vary, with some brokers offering accounts with no minimum deposit and others requiring a more significant amount. Micro accounts are popular among scalpers due to their low minimum deposit requirements, typically ranging from $1 to $50.

- Fees and Commissions:

Understanding the fee structure is crucial. Scalping involves opening and closing multiple positions quickly, leading to higher transaction volumes. Some brokers offer low or even zero commission accounts, but it’s important to check for other fees like spreads, inactivity fees, or withdrawal fees.

- Regulation and Security:

A broker’s regulatory status is a critical factor. It’s essential to choose a broker that is regulated by reputable financial authorities to ensure the safety of your funds and trading activities.

- Customer Support:

Effective and reliable customer support is vital. This includes availability through various channels like email, phone, or live chat, and responsiveness to trader inquiries and issues.

- Reputation:

Researching a broker’s reputation through reviews, ratings, and trader comments can provide valuable insights into their reliability and the quality of their services.

- Scalping-Specific Features:

Some brokers are particularly suited for scalping due to their specific features, like Pepperstone, known for low latency trading, or Tickmill, focusing on tight spreads.

In conclusion, the best scalping broker for you will depend on your specific needs and trading style. Consider the factors mentioned above and conduct thorough research to choose a broker that offers the best combination of trading conditions, platform features, instrument variety, and support services.

Comparison Table: Key Features of Top Scalping Brokers

| Feature | Importance | Ideal Broker Characteristics |

| Trading Conditions | High | Low spreads, fast execution, minimal slippage |

| Platform and Tools | High | User-friendly platforms like MT4/MT5, advanced trading tools |

| Tradable Instruments | Medium | Wide range of instruments for diverse strategies |

| Account Types | Medium | Various account types with low minimum deposits |

| Fees and Commissions | High | Competitive fee structure, transparency in costs |

| Regulation and Security | High | Regulated by reputable financial authorities |

| Customer Support | High | Effective and accessible customer service |

| Reputation | Medium | Positive reviews and strong industry standing |

Selecting the right scalping broker requires balancing these factors to match your specific trading requirements and risk tolerance.

IC Markets

IC Markets is a well-known broker in the forex trading industry, renowned for its suitability for scalping strategies due to its low spreads and fast order execution. Founded in 2007, IC Markets is regulated by several top-tier authorities including CySEC, ASIC, FSAS, and SCB, which adds to its credibility and trustworthiness.

Pros of IC Markets:

- Regulation and Security: IC Markets is highly regulated, offering trader money protection and operating in a secure environment.

- Low Trading Fees: The broker is known for its low trading fees, particularly for forex, and does not charge inactivity or withdrawal fees. However, it’s worth noting that financing rates for CFDs are high.

- Platform Variety: Offers popular trading platforms like MetaTrader 4, MetaTrader 5, and cTrader, catering to various trading needs and styles.

- Diverse Asset Range: Provides a range of trading instruments including forex, CFDs, bonds, stocks, futures, and cryptocurrencies, though primarily focuses on CFDs.

- Advanced Trading Features: The platforms are equipped with features like advanced charting tools, economic calendars, and support for automated trading.

Cons of IC Markets:

- Limited Availability: Not available in several countries, including the USA and Canada, which restricts its accessibility for traders in these regions.

- Outdated Platform Interface: Some users may find the interface of MetaTrader platforms provided by IC Markets outdated and less user-friendly compared to modern brokers.

- Limited Asset Classes: The broker mainly offers CFDs, so it’s not suitable for traders interested in investing in tangible assets like stocks or ETFs.

- Support Quality: While customer support is friendly, they may not always provide thorough answers.

- Security Concerns: The lack of two-step authentication and the practice of sending passwords via email may raise security concerns for some users.

- Limited Research and Analysis: IC Markets does not provide extensive financial information or analysis about the assets, which might be a disadvantage for traders who rely on this data.

In summary, IC Markets is a competitive choice for traders, especially those interested in scalping, due to its low fees and diverse range of platforms and trading instruments. However, its limited asset classes, availability, and concerns regarding platform usability and security are aspects to consider. As with any trading platform, it’s important to weigh these pros and cons against your specific trading needs and objectives.

TechBerry

TechBerry, categorized as a “Social Trading Analytical Platform,” is a unique offering in the forex trading landscape. It operates by collecting and analyzing trading data from over 100,000 forex traders globally. This data is used to formulate trading strategies, leveraging an inbuilt deep learning algorithm. TechBerry provides various subscription packages, including a 14-day trial period.

Pros:

- It offers automatic forex signals based on a vast amount of data.

- There are different packages available to suit varied needs.

- TechBerry provides real-time statistics and a 14-day free trial.

- The platform includes dedicated support for users.

Cons:

- The service is limited to MetaTrader platforms only.

- The minimum deposit is $500, which is quite high.

TechBerry’s approach, combining AI with extensive trader data, presents potential advantages.

Exness

Exness is a well-established forex broker that caters to a variety of trading styles, including scalping. Founded in 2008, it is known for offering a diverse range of trading instruments and platforms, with a focus on CFD forex trading. Here’s a detailed look at the pros and cons of Exness as a scalping broker:

Pros of Exness for Scalping:

- Competitive Spreads and Fees: Exness offers some of the lowest spreads, with as low as 0.3 pips on standard accounts and zero spread on professional accounts. This is particularly beneficial for scalpers who thrive on tight spreads.

- Wide Range of Trading Instruments: Exness provides access to over 100 forex pairs (major, minor, and exotic), popular stocks, commodities, indices, and cryptocurrencies, giving scalpers a wide range of options to trade.

- Regulation and Security: Exness is multi-regulated, which includes oversight by reputable entities like CySEC and FCA. This ensures a secure trading environment.

- Platform Diversity: Exness offers various trading platforms, including MetaTrader 4, MetaTrader 5, and proprietary platforms like the Exness Trader App and Exness Terminal. These platforms cater to different levels of trading experience.

- Instant Withdrawals and Strong Financial Audits: Exness is known for its quick withdrawal process and financial audits by Deloitte, ensuring transparency and reliability.

Cons of Exness for Scalping:

- Limited Educational Resources for Beginners: Exness does not provide extensive educational material for beginners, which can be a drawback for novice traders starting with scalping.

- Limited Range of Financial Instruments in Certain Categories: While Exness offers a wide range of forex pairs and stocks, it has a more limited selection in other categories like commodities and indices.

- Account Types and Accessibility: The broker offers various account types, but some accounts may require higher minimum deposits, which might not be suitable for all scalpers.

- Geographical Restrictions: Depending on the trader’s location, there may be restrictions on leverage and access to certain financial instruments due to regulatory policies.

In conclusion, Exness is a viable option for scalpers, especially due to its low spreads, diverse trading instruments, and reliable regulatory framework. However, traders should consider the limitations regarding educational resources and the range of certain trading instruments. As with any trading style, it’s important for scalpers to understand their platform and strategy thoroughly, considering both the potential risks and benefits.

What are the key factors to consider when choosing a scalping broker in 2024?

How do I find out if a scalping broker is legit?

What are the risks of scalping?

How much money do I need to start scalping?

Where can I find more information about scalping brokers?

Popular queries