Broker reviews > Reviews > Interactive Firstrade checking review: Pros & Cons for 2023

Firstrade’s Commission-Free Trading and Features

Firstrade’s making waves as the go-to for those who don’t want to spend an arm and a leg on trading. They’re all about commission-free trades on mutual funds, ETFs, and other assets. Plus, they’ve thrown option trading into the mix without those pesky per-contract fees, which is pretty rare in the broker world. And get this – they’ve got 38 cryptocurrencies on offer and counting, which is a steal compared to what you might find elsewhere.

Pros

- Forget about minimum balances or getting dinged for not trading enough.

Option traders, rejoice! No extra costs per contract here. - They’ve got a treasure trove of learning materials, especially if you’re looking to get into options.

- Their personalized dashboard is like having your financial life at your fingertips – easy to track what matters most to you.

- Into more complex trading moves? They’ve got you covered with advanced orders like conditional ones and trailing stops.

Cons

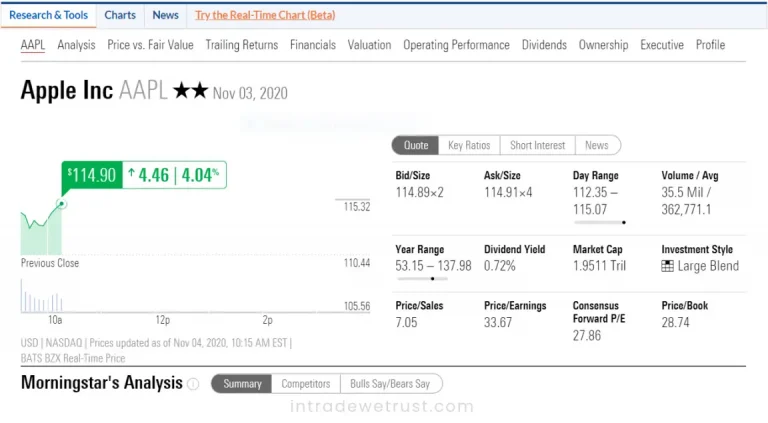

- The research tools? They’re pretty basic.

- Watch out for those margin rates – they’re on the higher side.

- Trying to get someone on the phone can be a bit of a mission.

- No luck if you’re looking to trade in FX, futures, cryptos, or dabble in fractional shares.

- It’s all about the US market here, international traders might feel left out.

- They make their money from order flow, which might not be everyone’s cup of tea.

Broker reviews > Reviews > Interactive Firstrade checking review: Pros & Cons for 2023

Firstrade Navigator and Revenue Strategies

Getting started with the Navigator means getting the green light from Firstrade’s customer service first.

Here’s a Quick Tour:

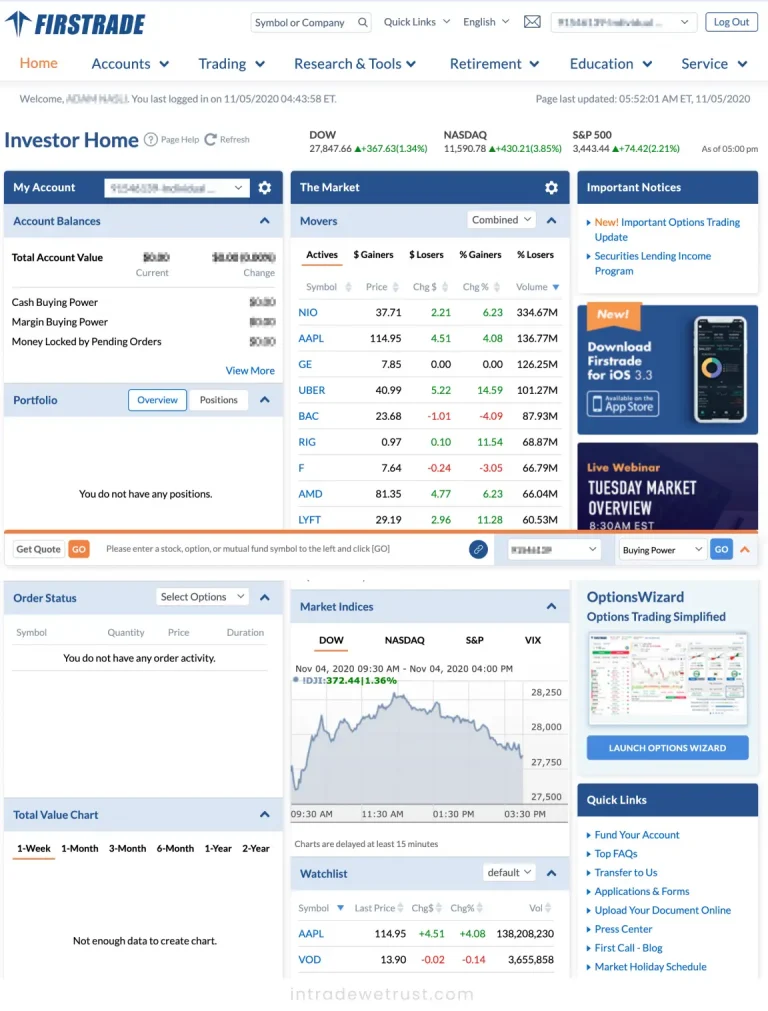

- Keeping Tabs on Your Money: The Navigator sums up your account neatly, showing off your positions, how much cash you’ve got, and what’s on order.

- Making Moves: Whether you’re buying or selling, setting up orders is straightforward.

- Staying in the Know: Real-time quotes keep you in the loop on various securities.

Let’s break down how Firstrade manages to keep the lights on without charging you commission fees. It might seem like magic, but it’s just smart business. They make money off margin interest, earn interest on your cash, charge for premium services, and get paid by market makers for order flow.

Firstrade’s Reliability, Security, and Benefits for Newcomers

Heard through the grapevine and seen in some online chatter, Firstrade’s been on the scene since the mid-80s, launching into the digital fray in ’97. Now, they’re juggling a cool $2.3 billion in assets. They’ve snagged an A+ from the Better Business Bureau and have all the right stamps of approval from the big finance watchdogs, FINRA and the SEC.

On the insurance front, Firstrade’s got you covered up to half a mil per account, including a quarter-mil in cash, through SIPC. They even add extra policy coverage up to $37.5 million in securities and $900k in cash per customer. But, there’s a big pot of money, $150 million, that’s the max they’ll dish out across all accounts, which, let’s be honest, is a pretty big safety net.

Firstrade is a dream for anyone just starting to dip their toes into investing because of its commission-free trading, low fees, abundant research tools and data, and top-notch educational content.

Instant Deposits and Navigating Firstrade for Newcomers

Feeling antsy about getting your funds ready to trade? Firstrade’s got your back with up to $1,000 of your deposit available for immediate trading while the rest clears. For any future deposits, the amount within your account balance is ready to roll immediately, and anything extra takes just four business days to become available for trading.

So, in a nutshell, Firstrade’s looking out for the newcomers with a safe, easy-to-navigate platform that’s light on fees and heavy on resources, making it a favorable environment for those new to investing.

What makes Firstrade an attractive option for stock traders?

Can international investors use Firstrade?

What types of accounts can be opened with Firstrade?

Popular queries