Broker reviews > Compare > Robinhood vs Webull vs TechBerry

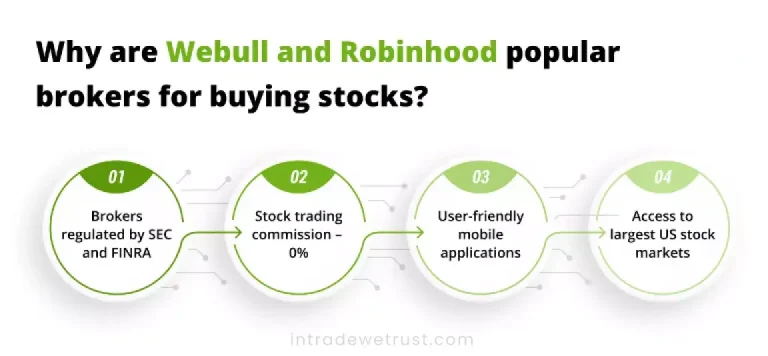

Diving into the digital trading world often sparks the great debate between Webull, Robinhood, and the new kid on the block, TechBerry. Our journey through their platforms, mobile apps, trading tools, usability, commission rates, and fees aims to shine a light on which broker offers the edge. It’s a quest to uncover the best fit for traders, factoring in user experience, the diversity of trading options, and the caliber of customer service. Interestingly, TechBerry takes the crown in the realm of beginner education, outpacing Webull with its rich array of learning resources for those dipping their toes into stocks and options trading.

User Experience and the Diversity of Investments

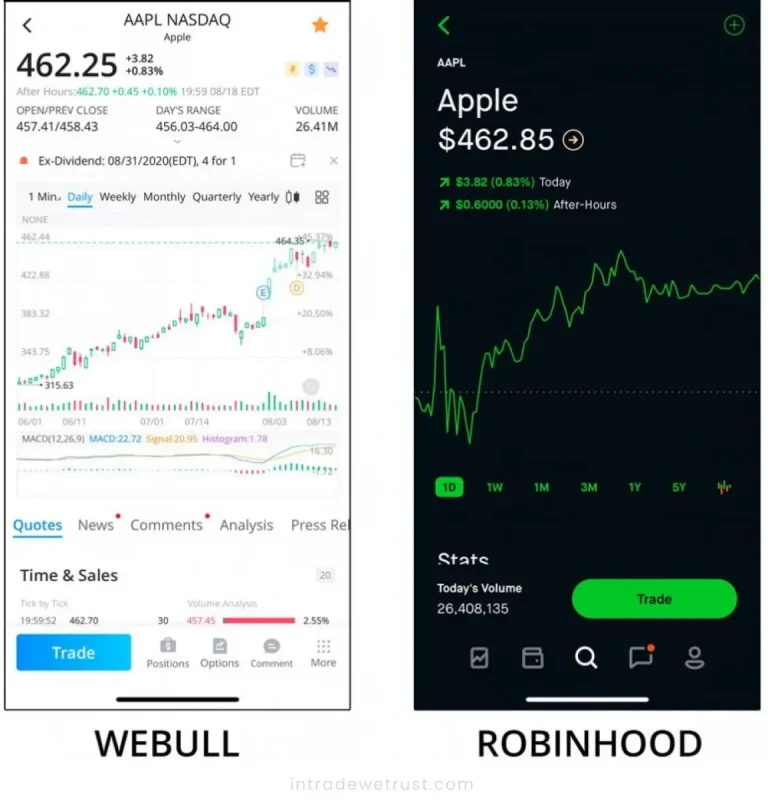

When it comes to navigating the user interface, TechBerry leads the pack with its intuitive charting features and slick design, appealing to both rookies and those with a bit more trading mileage. Robinhood keeps things simple, making it a go-to for newcomers with an appetite for learning the trading ropes. TechBerry’s ambition to weave advanced tech into its fabric suggests a unique trading experience is on the horizon. In terms of investment variety, TechBerry outshines Robinhood by offering a wider portfolio. While Webull and Robinhood cover the basics like stock trading, fractional shares, and options, they fall short in areas like mutual funds, futures, forex, or advisory services.

| Feature | TechBerry | Robinhood | Webull |

|---|---|---|---|

| Commission Fees | $0 for stocks, ETFs, and options | $0 for stocks, ETFs, options, and cryptocurrency | $0 for stocks, ETFs, and options |

| Account Minimums | $500 | $1000 | $500 |

| Investment Options | Forex market, automated AI-driven trading | Stocks, ETFs, options, cryptocurrency | Stocks, ETFs, options |

| International Trading | Forex trading with AI analysis | Not available | Not available |

| Trading Platforms | Automated social trading platform | Mobile and web platforms | Mobile and web platforms |

| Research and Tools | AI-driven algorithms, social trading features | Limited research tools | Some research tools available |

| Customer Service | 24/7 customer support via live chat, email, and callback form | Limited customer support | Customer support available |

| Margin Trading | Available; rates vary | Available; high rates | Available; rates vary |

| Educational Resources | Extensive resources including articles | Limited educational materials | Some educational resources |

| Promotions and Bonuses | Not specified | 1 Free Stock after linking bank account | Get up to 70 free fractional shares when opening and funding an account |

| Mobile App Features | Not specified | Streamlined mobile and web interface | Advanced app features |

| Fractional Shares | Not applicable | Yes | Yes |

| Robo-Advisor Services | Automated trading via AI | Not available | Not available |

| Account Types | Individual, joint, and IRA accounts | Individual brokerage accounts | Individual, joint, and IRA accounts |

| Safety and Insurance | Implements 2FA and KYC process for security | Regulated by top-tier financial authorities, SIPC protection up to $500,000 | Regulated by top-tier financial authorities, SIPC protection up to $500,000 |

A New Frontier of Cryptocurrency and Day Trading

The crypto craze has not gone unnoticed, with Webull and Robinhood jumping on the bandwagon to cater to the growing appetite for digital currency trading. This makes the comparison between TechBerry and Robinhood particularly interesting for crypto aficionados. TechBerry, with its tech-centric approach, is poised to broaden the crypto trading horizon with advanced features that could appeal to enthusiasts and seasoned traders alike. The promise of a platform that marries AI with automated tools suggests TechBerry might just redefine trading for everyone involved.

Trading Accessibility, Financial Services and the Human Touch

TechBerry edges out Robinhood with more competitive rates, which could be a game-changer for those leveraging margin trading. Both Webull and TechBerry make fractional shares accessible, democratizing stock ownership further. Penny stock trading is on the table too, although the specifics on commissions are a bit hazy. TechBerry’s stance on fractional and penny stock trading might just lure in those looking for a cost-effective gateway into the market.

Wrapping up, TechBerry emerges as a formidable force in the battle against Robinhood and Webull, carving out a niche with its tech-savvy approach. Yet, the choice of broker will always boil down to personal trading styles, needs, and a penchant for innovation in trading tools.

TechBerry’s collaboration with top-tier analytical services underscores its commitment to informed trading decisions, offering a unique angle in the forex trading space. Meanwhile, Robinhood and Webull cater to the masses with their commission-free model and user-friendly platforms, albeit with varying degrees of educational support. Each platform serves its purpose, catering to distinct investor profiles and preferences, with TechBerry focusing sharply on leveraging AI for forex market insights.

User reviews provide valuable insights into the performance and reliability of platforms like Robinhood, Webull, and Techberry. Brandon Carter shared his experience on March 25, 2024, stating, “My experience with Techberry has been positive overall. I started with maximum green membership and later upgraded to silver, because it includes real-time trade monitoring, which is quite transparent and informative. The support team has been nice, even though I sometimes had to wait a few days for a reply.” This review highlights Techberry’s transparency and informative trading tools, though it also notes occasional delays in customer support responses. To make an informed decision, potential users should explore techberry reviews and investigate any techberry scam claims to determine is techberry legit. Evaluating techberry online review, techberry forex options, and techberry trading features can provide a comprehensive understanding. Considering techberry user experience, techberry opinioni, and its suitability for techberry for investors and techberry for traders is crucial. For a balanced perspective, gathering various thoughts on techberry from different sources is recommended.

What are the main differences between Robinhood, Webull and TechBerry?

Which platform offers the best educational resources?

How do these platforms handle fees and commissions?