Broker reviews > Reviews > SoFi Invest review

Introduction to SoFi’s Investment Platforms

For those dipping their toes into the investment world or watching their wallets, SoFi Automated Investing is a breath of fresh air with its easy-to-use, wallet-friendly platform.

Now, if you’re on the lookout for the high-tech trading bells and whistles, SoFi’s Active Investing might seem a bit basic since it skips the fancy trading features. But hey, no fees on stocks and ETF trades? That’s pretty sweet. Dive into a SoFi brokerage review if you’re curious about the ins and outs of their trading reliability.

Let’s talk Pros and Cons:

Pros

- Say goodbye to investment management fees.

- Jump in with just $1 to start.

- Handy extra tools for your lending and cash management needs.

- Got questions? CFP professionals are on standby for all members.

- Plus, who doesn’t love social events, exclusive deals, and other cool perks?

Cons

- Looking to harvest tax losses? Not here, you won’t.

- Don’t expect discounts on other banking products.

Want to tweak your portfolio? That’s a no-go. - Exploring SoFi’s Active and Automated Investment Options

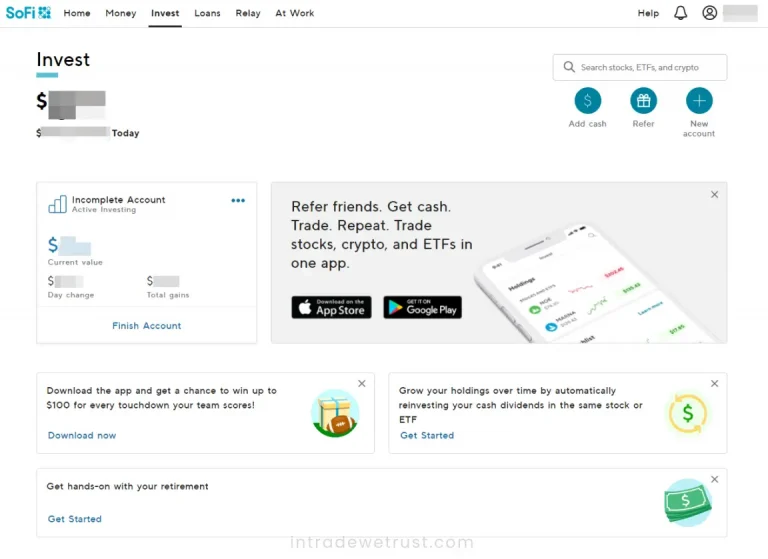

Active Investment Portfolio

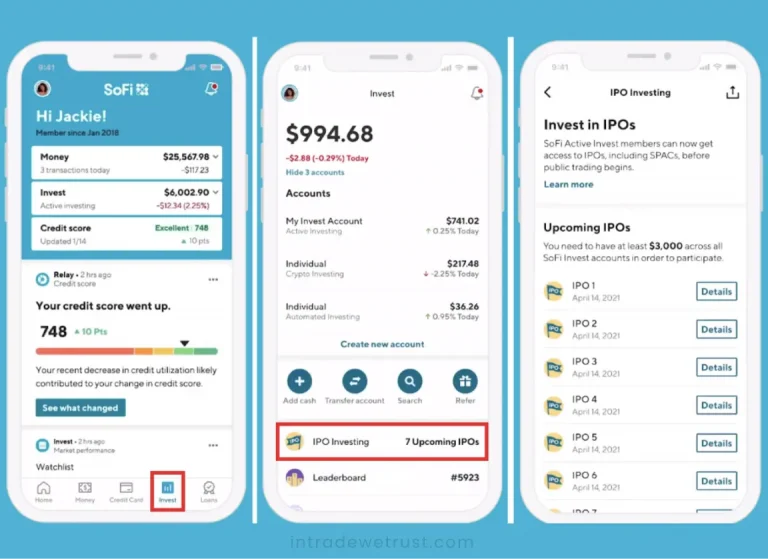

SoFi’s Active Invest lets you steer the ship, with total control over buying and selling stocks and ETFs without the drag of commission fees. Want a piece of the crypto action anytime, or fancy investing in fractional shares?

Perfect for the traders who like to tailor their investment wardrobe, SoFi Active Invest also rolls out the red carpet to exclusive events, discounts, and more. And for those eyeing the thrill of IPOs, yep, you get a front-row seat to the public sale of shares from the private companies’ VIP lounge.

Diving into the world of investing with SoFi’s Automated Investing feels a bit like having a financial butler. You tell them what your goals are—maybe it’s buying a house, saving for retirement, or planning that dream vacation—and they whip up a personalized portfolio for you, mixing SoFi’s own ETFs with picks from other places like Vanguard. It’s like ordering a custom meal based on your taste, risk appetite, and how long you’re willing to wait for it to cook.

Retirement Planning and Safety Measures with SoFi

When it’s time to think about retirement, SoFi serves up options whether you’re the type who likes to get hands-on with your investments or prefers to set it and forget it. Their robo-advisor crafts a mix of stocks and bonds tailored just for you, based on how much risk you’re comfy with and when you plan to retire.

When it comes to keeping your stash safe, SoFi’s got the vault locked tight. Thanks to Apex Clearing stepping in to safeguard customer assets, you’re looking at SIPC insurance up to $500,000 and FDIC sweeps for bank protection. And for those tucking away savings, SoFi’s protection goes up to a whopping $1.5 million—way beyond the usual bank account insurance.

Can I automate my investments with SoFi Invest?

What are the minimum investment requirements for SoFi Invest?

Does SoFi Invest offer retirement accounts?

Popular queries