Broker reviews > Compare > Charles Schwab vs Fidelity vs TechBerry

In the vast and ever-evolving landscape of online brokerage, Charles Schwab and Fidelity stand tall as beacons of reliability and comprehensive service. Both powerhouses offer an impressive array of investing platforms, securing their positions as leaders in the industry. They’re celebrated not just for their longevity but for a product range that encompasses everything from stocks to cryptocurrency options. While Charles Schwab invites investors to explore futures trading, Fidelity distinguishes itself with its robust mutual funds portfolio. This section sets the stage for understanding the strengths and breadth of services provided by these industry stalwarts.

TechBerry – A New Contender

Enter TechBerry, a novel force in the brokerage world, wielding technology as its sword. In contrast to the traditional offerings by Schwab and Fidelity, TechBerry potentially zeroes in on tech-driven investment solutions, offering a fresh perspective to the digital trading domain. Its approach hints at a future where AI and machine learning aren’t just add-ons but core components of investment strategy, promising to revolutionize how we think about brokerage services.

| Feature | TechBerry | Fidelity | Charles Schwab |

|---|---|---|---|

| Commission Fees | $0 for stocks, ETFs, and options | $0 for U.S. stocks and ETFs | $0 for stocks, ETFs, and options |

| Account Minimums | $500 | $1000 | $1000 |

| Investment Options | Forex market, automated AI-driven trading | Stocks, ETFs, mutual funds, options, cryptocurrency, bonds, CDs, international investments | Stocks, ETFs, mutual funds, options, bonds, futures |

| International Trading | Forex trading with AI analysis | Charges vary by country; high fees for non-US stocks | Global account for trading in international markets; commissions vary by region |

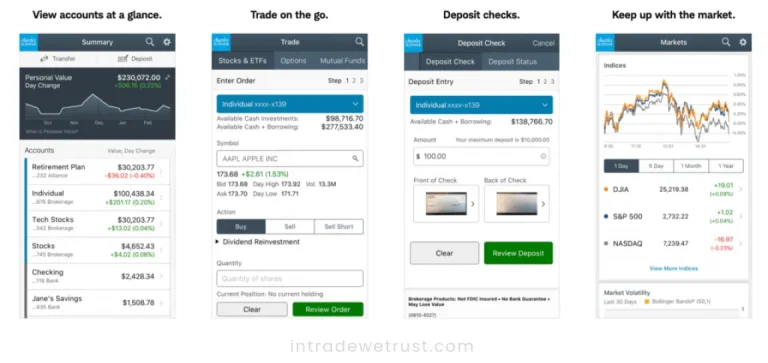

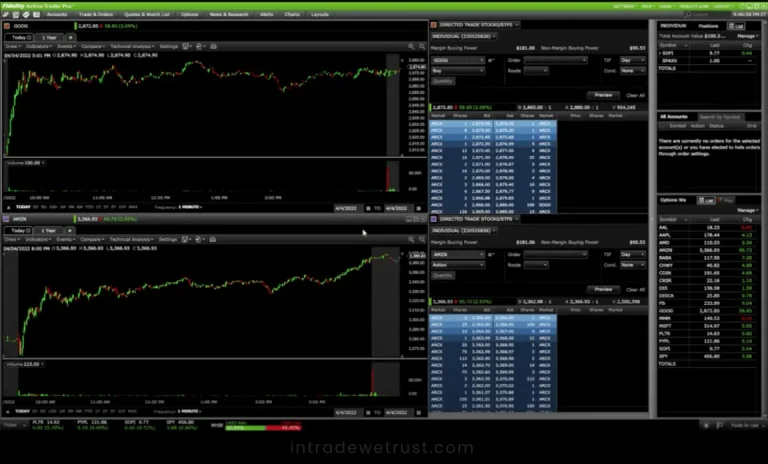

| Trading Platforms | Automated social trading platform | Active Trader Pro, web, mobile app | StreetSmart Edge (advanced), web, mobile app |

| Research and Tools | AI-driven algorithms, social trading features | Extensive research from third-party firms; detailed investment research on over 4,500 stocks | Investment research, Schwab Equity Ratings, market insights |

| Customer Service | 24/7 customer support via live chat, email, and callback form | Highly rated, various contact options | 24/7 customer support, branches nationwide |

| Margin Trading | Available; rates vary | Available; rates vary | Available; competitive margin rates |

| Educational Resources | Extensive resources including articles | Comprehensive educational materials | Wide range of educational materials, workshops, and webinars |

| Promotions and Bonuses | Not specified | No current promotions (2024) | Various promotional offers depending on account type and deposit amount |

| Mobile App Features | Not specified | Advanced features, real-time quotes | Mobile app with trading tools, research, and real-time data |

| Fractional Shares | Not applicable | Yes, investments as low as $1 | Yes, Schwab Stock Slices offers fractional shares |

| Robo-Advisor Services | Automated trading via AI | Fidelity Go, competitive rates | Schwab Intelligent Portfolios, no advisory fees |

| Account Types | Not clearly specified | Wide range including IRA, 401(k), brokerage, HSA | Various including brokerage, IRA, education savings, and more |

| Safety and Insurance | Implements 2FA and KYC process for security | High level of security; FDIC-insured options available | Enhanced security measures; SIPC and additional insurance coverage |

Pricing, Platforms, and the Investor Experience

When it comes down to dollars and cents, Charles Schwab and Fidelity are closely matched, with both offering enticing no-fee structures across many services and competitive options contract rates. Their commitment to accessibility is evident, requiring no minimum investment for opening basic brokerage accounts.

Here, TechBerry might shake things up with innovative pricing models aimed at attracting a diverse clientele, emphasizing automated investing through advanced platforms. This comparison peels back the layers of each broker’s approach to pricing and platform functionality, highlighting how they cater to different investor needs and preferences.

The TechBerry Edge – Innovation Meets Investment

TechBerry doesn’t just join the fray; it aims to redefine it. With a unique proposition of AI-driven trading strategies and a sophisticated social trading platform, TechBerry stands poised to attract those at the intersection of technology and investment. It’s not merely about competing on pricing or product offerings but about offering a new paradigm in online trading. By blending AI algorithms with a commitment to security and customer-focused service, TechBerry aspires to be the platform of choice for the modern, tech-savvy investor, setting a new benchmark in the brokerage industry.

When comparing Charles Schwab, Fidelity, and Techberry, it’s essential to delve into the user experiences and reviews to make an informed choice. Tom Longard shared his positive experience with Techberry on May 11, 2024, stating, “I’ve signed up with techberry.online as both a Trader and an Investor, and I’m excited about their incredible AI. I initially uploaded my trading activity and quickly realized the benefits, prompting me to get a membership. It’s proven to be quite profitable, and the flexibility to upgrade your plan at any time is a big plus. If you’re interested in making money, I highly recommend trying out this platform!” This endorsement highlights the potential profitability and flexibility that Techberry offers. However, it is crucial to explore techberry reviews, including any techberry scam allegations, to determine is techberry legit. By examining techberry online review and techberry forex capabilities, investors and traders can gain a comprehensive understanding. Considering techberry user experience, techberry opinioni, and techberry trading options can help in forming an informed opinion about techberry for investors and techberry for traders. For balanced insights, seeking thoughts on techberry from various sources is advisable.

What are the key advantages of Charles Schwab, Fidelity and TechBerry for investors?

Which platform offers the best retirement planning resources?

How user-friendly are these platforms for new investors?