Broker reviews > Reviews > Tastytrade review

Despite having a silly name, Tastytrade is a fantastic option for serious traders who want to reduce their commissions while still having a powerful trading experience. It can compete on price with some excellent brokerages, especially if you trade options and cryptocurrencies, where it caps commissions.

Although this broker only recently made its debut, some people in its management were involved in developing Thinkorswim, the most well-known retail broker that TD Ameritrade eventually acquired. Because mutual funds are absent and trading is essential, short-term traders will probably feel more at home here than long-term investors.

Pros

- Resources and educational material: Currently, Tasty Live creates 10 hours of live, exclusive content every day to offer financial advice, investing methods, and entertainment connected to option trading and the stock exchange. The “follow page” on Tastyworks trading platform review is where it posts all trades, and from there, you can filter, sort, and choose which underlying equities you want to see transactions for. Overall, tastytrade provides you with actionable knowledge based on research and expertise that can assist you in expanding your holdings as a do-it-yourself investor.

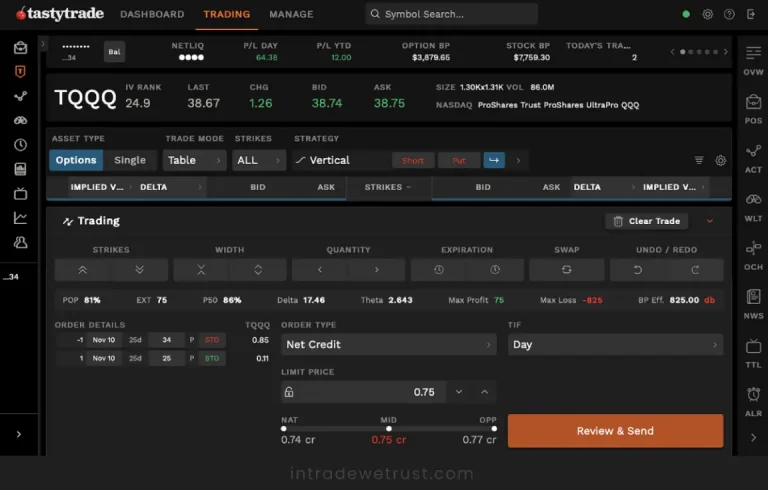

- Personalized trading experience: According to Tastytrade platform review, web, mobile, and desktop versions of tastytrade provide features you can customize, including watchlists, position data, and trade page information like volume, theta, and delta.

- Advanced tools created explicitly for options traders: Tastytrade was designed with options traders in mind. Thus, most resources you’ll need for evaluating and using derivatives are already included in the platform. For example, you may determine risk profiles of several open positions, and the Trading Chain tab enables you to follow a trade from the beginning, including any rolls, closing legs, or changes.

Cons

- Complicated for novice options traders: Novice traders might consider this platform complex and intimidating. Even having a Tastytrade review, it has a longer learning process than other platforms that can offer more basic capabilities because it is designed for frequent and experienced traders.

- Limited selection of fixed-income securities: Tastytrade was explicitly designed for options traders and excludes numerous conservative types of protection like corporate, municipal, and foreign government-issued bonds. Treasury bills, notes, and bonds issued by the United States are sole fixed-income securities.

-

Paper trading is not supported: Paper trading, which helps develop and evaluate methods, is not endorsed by tastytrade.

What happened to Tastytrade

Tastytrade has undergone several modifications over some years now including changing their name from tastytrade to tastyworks and back again.

Here are a few of the significant changes:

Website:

Tastywork.com was initially the web domain for tastytrade company before it was changed to tastytrade.com, however tastywork.com still work just that it is redirected to the new one.

Applications for Trading:

The company new name reflects on your PC, mobile apps (iOS & Android), and web browser platforms. To notice the changes in branding, your installed apps will need to be updated.

Management of accounts

You can access your account administration page through manage.tastytrade.com on the website.

Support:

Phone, chats and email are tatsytrade means of communication which function normal during transition.

Is Tastytrade a good broker?

Investors seeking low-cost, multi-asset trading opportunities might consider Tastytrade. Particularly seasoned traders will like the extensive analysis tools and cutting-edge trading technologies.

The top stock/options broker is unquestionably tastytrade. Their customer service staff is really helpful and quick to answer. Because of their slow reaction times or uninformed employees, other brokers leave you with more queries than solutions.

Particularly for options traders, the Tastytrade platform’s user interface (UI) is particularly simple to use.

Tastytrade provides options traders with the lowest commissions, which are set at $20 for trade opening and free for trade closing. Additionally, no other “free” brokers are less expensive because they defraud you with subpar PFOF order fills.

The Tastytrade platform review offers a variety of features and tools for active traders, even though it may not be the best option for everyone. It’s important to keep in mind that the learning process can seem challenging at first, but that the effort is worth it in the form of a rewarding and worthwhile trading experience.

What is the minimum account at Tastytrade?

It would be best to read the Tastyworks brokerage review before deciding to fund your account to learn more about the minimum account balances. There are no requirements for minimum deposits at Tastytrade. Without making any deposits, you can open a cash or margin account. It’s easy to create an account and use the platform demo.

However, depending on the account level and available purchasing power, you’ll have different trading possibilities. The two sorts of accounts are cash and margin. There is no minimum balance requirement to start a cash account, but if you want to qualify for margin privileges—which let you buy stocks or ETFs on leverage—you must have a balance of at least $2,000.

In addition to checking the Tastyworks review about marginal account minimums, you may have to learn about other minimums that Tastytrade may impose.

Bitcoin Trading

There are no minimums for trading cryptocurrency at Tastytrade other than a $1 trade minimum. You only need to request permission in the account settings section to get going.

To ensure you live in a state where cryptocurrency trading is legal, the broker verifies your account’s residence information. As soon as it’s confirmed, you can start trading. Typically, the procedure takes a day.

Minimum Day Trading Balance

You must know one additional account minimum if you intend to day trade. Placing more than 3 intraday round trades in a recurring five-day period is the formal definition of day trading.

Day traders must keep a minimum $25,000 balance in their accounts. The trader is only permitted to execute 3-day weekly transactions if there is less than that in the investor’s account. Knowing that the $25,000 daily minimum will comprise a cash balance, open trades, or an equal amount of the two will help you.

The Futures Market

There are several account/margin requirements for trading futures at Tastytrade. Two primary divisions of futures trading account minimums exist: intraday and overnight. Depending on the futures contracts you are selling, you may require a certain amount of money in your account. The resulting margin needs to reflect the various prices of each futures contract.

The margin requirements for overnight trades are substantially greater than those for intraday transactions. To carry one regular /ES contract overnight, you would need at least $14,440 in your trading account. Micro agreements, however, call for a balance of $1440.

Choice Trading

Tastytrade offers far more lenient minimums for options than many other brokers. Tastytrade enables traders to create positions with trade-specific balance requirements, unlike some brokers who mandate that customers maintain a minimum balance (typically $2000) to trade complex options strategies.

For instance, if you sell an option vertical 5 points wide, you’ll need at least $500 less whatever credit you already have. You need the extra $250 in your account to cover up the difference, assuming you can get $250 in credit for your spread.

What makes Tastytrade different from other trading platforms?

Does Tastytrade provide tools for risk management?

What are the fees for trading on Tastytrade?

Popular queries