Broker reviews > Reviews > J.P. Morgan Self-Directed Review: Pros & Cons for 2023

Overview of J.P. Morgan Self-Directed Investing

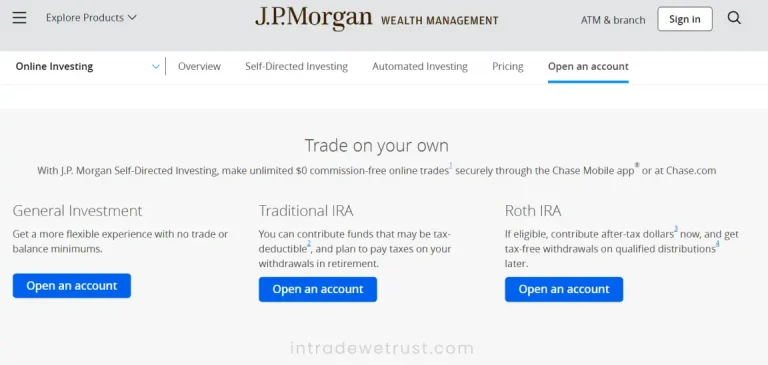

Thinking about taking the reins on your investments with J.P. Morgan? Here’s what you need to know about their Self-Directed Investing platform – it’s like having the keys to the investment kingdom, minus the hefty fees. Let’s walk through what makes it stand out and where it might leave you wanting more.

Pros

- User-Friendly Vibes: Jumping into their platform is as smooth as your favorite app. Whether you’re on your phone or browsing their website, everything looks and feels consistent, making it a breeze to navigate.

- Everything Under One Roof: Got a Chase account? Perfect. It links up with your J.P. Morgan investments, so you can manage your money without breaking a sweat.

- Commission-Free is the Way to Be: Whether it’s stocks, ETFs, or mutual funds you’re after, you can trade without those pesky commissions biting into your profits. It’s a feature that sets them apart, especially when you consider how many others still charge for these trades.

Cons

- Crypto: If you’re looking to dive into Bitcoin and its digital cousins directly, you’ll need to look beyond J.P. Morgan. Crypto trading isn’t on the menu here.

Limited Trading - Playground: Dreaming of futures or forex trading? You’ll hit a wall with J.P. Morgan, as they keep things more traditional, leaving out some of the spicier trading options.

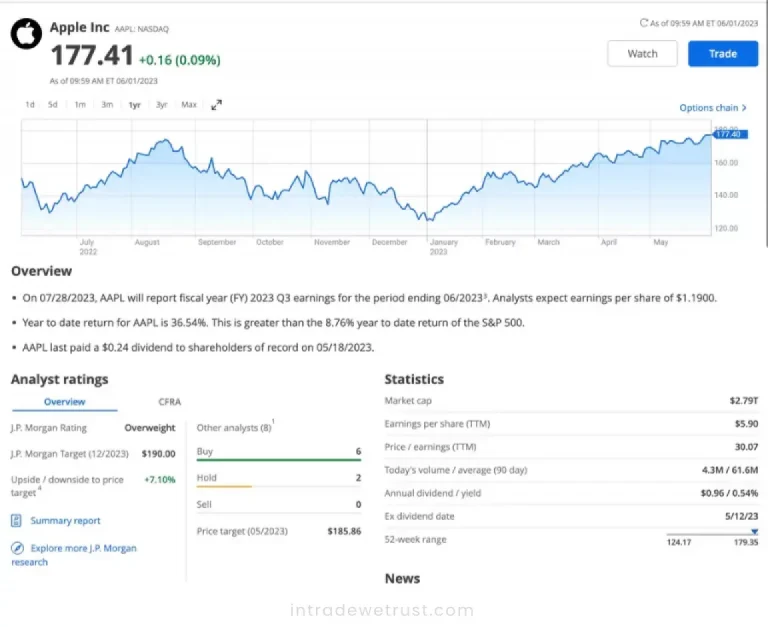

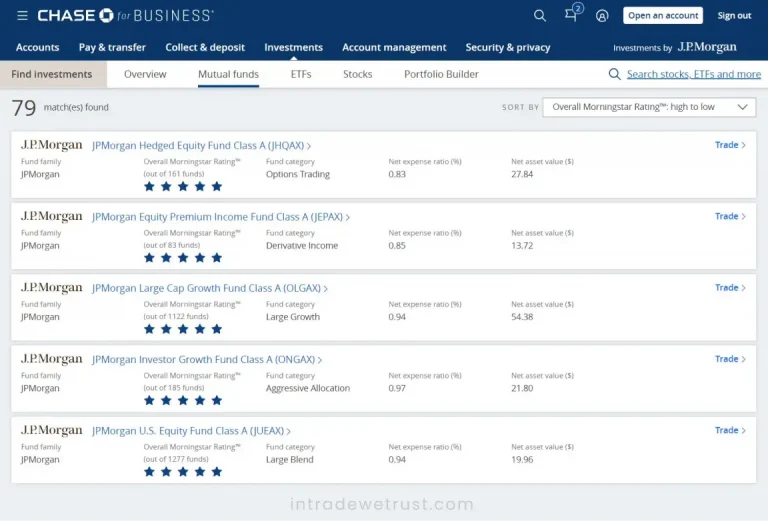

- Research Tools Could Use a Buff: While you do get exclusive access to J.P. Morgan’s own research, which isn’t nothing, the platform doesn’t quite stack up in the research department compared to other brokers. You get some basics and Morningstar insights, but if you’re a data junkie, you might find it a bit light.

What’s the Deal with J.P. Morgan Self-Directed Investing?

It’s an online account that lets you call the shots on your investments without dishing out commissions for every move you make. And the best part? You can do it all from the comfort of the Chase Mobile app.

Think of it as your investment playground. You’ve got everything from stocks and ETFs to options, mutual funds, and even fixed income. And the cherry on top? Unlimited online trading on stocks, ETFs, and mutual funds without the commission fees. Just a heads up, though: there might be some extra fees lurking around the corner for option contracts and a few other services.

Understanding J.P. Morgan’s Revenue Strategies and Investment Costs

- Interest on Idle Cash: Park your funds in your account, and you’ll earn a tiny bit of interest on them. Opt for a money market fund sweep for a chance at higher rates.

- Price Improvement: J.P. Morgan is on a mission to snag you the best possible price on your trades. They’re all about transparency in how they execute orders, even if it means playing the hedging game now and then to minimize risk.

- Payment for Order Flow: It’s a bit of insider baseball, but J.P. Morgan can earn a bit on the side from PFOF through various credits and rebates. You won’t see this spelled out in your account review, but it’s tucked away in their Rule 606 disclosures. And just for the record, they’ve said they didn’t get compensated for order flow in their latest report.

What’s It Gonna Cost You to Invest with J.P. Morgan Self-Directed?

Here’s the lowdown on what you can expect to shell out in fees and commissions:

- The Freebies: Trading stocks, ETFs, mutual funds, and options that are listed in the U.S.? That’s on the house. No base commissions here, which is pretty sweet.

- Need a Helping Hand: If you decide you want a bit of assistance with your trades, there’s a $25 fee for that extra touch of broker support.

- The Nitty-Gritty on Sales: Selling ETFs or stocks? There’s a tiny fee that ranges from barely there (like, $0.0000231 per trade) up to $0.01 to $0.03 for every $1,000 of the principal. Basically, it’s a small change.

- Getting Fancy with Options: Dabbling in options? Each contract will set you back $0.65. If you’re putting together a strategy with up to four legs, those fees can add up, but it’s still not too steep.

- The Extras: Decided to exercise or assign your options? No worries, that part’s free. However, if your trades involve some regulatory transaction charge, think tiny – $0.01 to $0.03 per $1,000 of principle.

- Special Securities: Looking into treasury bonds or newly issued CDs? No base commission to worry about. But if you’re trading municipal bonds, commercial bonds, or secondary market CDs, there’s a $10 commission plus $1 per bond (capping at $250 for ten bonds).

- The Odds and Ends: Closing a retirement account or transferring out? That’ll be $75, please. But transferring money around internally or making deposits and withdrawals? No fees, which is always nice to hear.

So there you have it. J.P. Morgan Self-Directed Investing keeps it pretty straight forward and cost-effective for the everyday investor. Whether you’re all about active trading or just want to occasionally adjust your portfolio, the fees won’t knock the wind out of your sails.

What are the key features of J.P. Morgan Self-Directed Investing?

Is there a minimum investment required to start trading with J.P. Morgan Self-Directed?

How secure is J.P. Morgan Self-Directed Investing?

Popular queries