Broker reviews > Reviews > Vanguard Review

Vanguard’s Investment Management Approach and Benefits

Vanguard stands out as a guiding light for those looking to navigate the waters of investment management. Offering a broad spectrum of investment goodies, from stocks and bonds to mutual funds and ETFs, Vanguard aims to gear folks towards their financial dreams. They’re the go-to guys for low-cost index funds and ETFs designed to mirror the dance of the market indexes. Plus, they’ve got a team of sharp fund managers who steer the ship of their actively managed funds, ensuring that your investments are more than just a shot in the dark.

Here’s the lowdown on the perks and quirks of setting sail with Vanguard:

Pros

- A Treasure Chest of Knowledge: Vanguard chock-full of guides, articles, videos, and podcasts all aimed at helping you set your financial North Star and chart a course to reach it. Opting for Vanguard means unlocking a trove of insights that keep you savvy about market trends and aid in steering your long-term investments.

- Your Money Works Even When Idle: Vanguard doesn’t just let your cash sit there; it moves your brokerage cash balances into money market funds sporting low expense ratios. They sweeten the deal with the VMFXX Federal Money Market Fund, ensuring your idle cash earns its keep at a rate that often outpaces the competition.

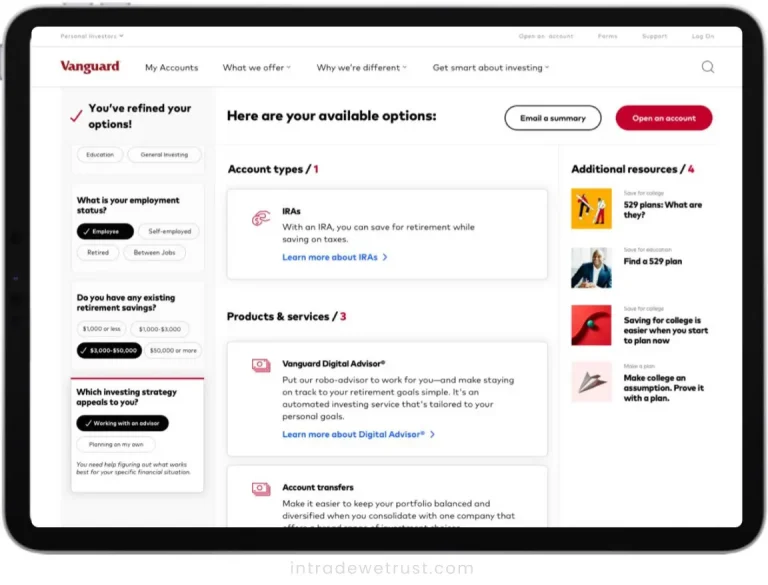

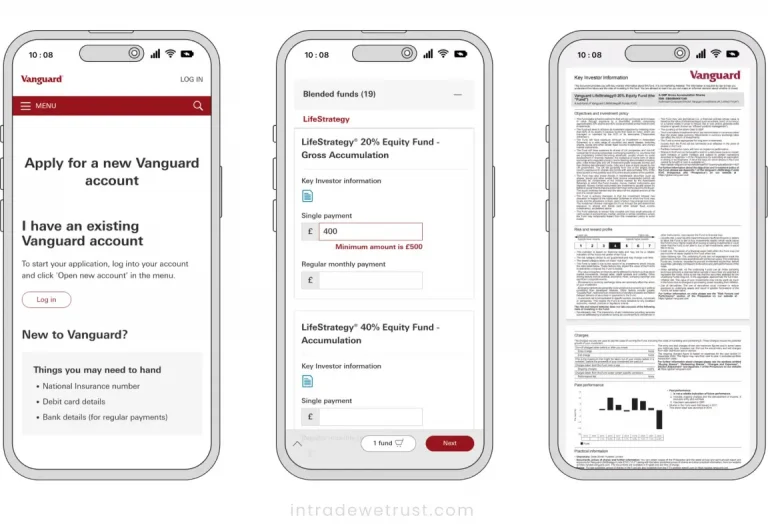

- Advice for All: Vanguard is on a mission to democratize financial guidance. They rolled out the Digital Advisor, a shiny, all-digital advisory service tailored for the younger crowd or anyone with straightforward investment goals. And for those wrestling with thornier financial puzzles, there’s the Private Advisor Services offering one-on-one time with financial experts.

Cons

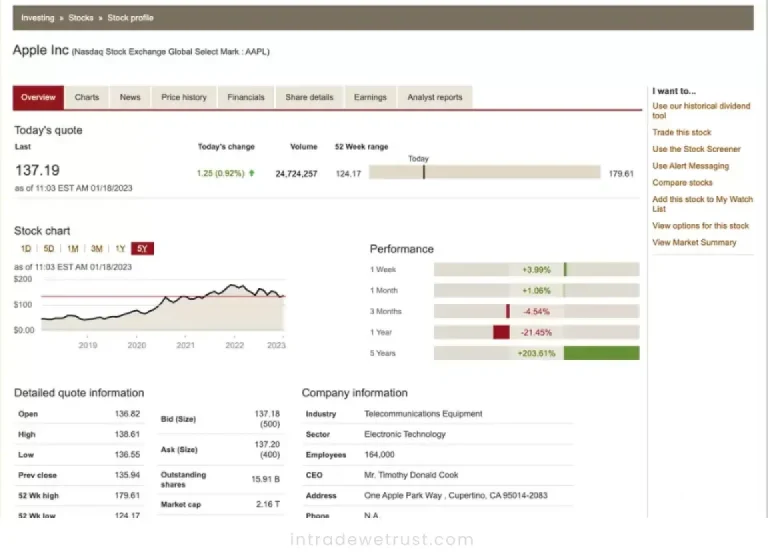

- A No-Frills Trading Experience: Designed with the passive, buy-and-hold investor in mind, Vanguard’s trading interface focuses on the essentials like balance and holdings, which is great if you’re playing the long game but might leave active traders wanting more.

- Could Use a Facelift: The main platform’s a bit on the dated side, especially in terms of its user interface and navigation. It seems Vanguard’s design energy is currently more tuned to their Digital Advisor product.

- News at a Leisurely Pace: Unlike many of its rivals, Vanguard doesn’t offer real-time streaming news. It’s a nod to their base of long-term investors for whom the latest headlines might not sway the investment compass. However, this choice highlights that Vanguard is more suited for those committed to the long haul rather than those looking to actively trade.

Vanguard’s Positioning and Offerings for Investors

Vanguard, with its solid foundation and wealth of resources, is a beacon for investors looking towards a secure financial future. Whether you’re just starting out or have a portfolio that’s as seasoned as a sea captain, Vanguard offers tools and guidance to help navigate your journey. Just bear in mind, the experience is tailored more for those happy to set their course and let their investments grow over time, rather than day traders looking for the thrill of the chase.

How does Vanguard stack up as a choice for investors? Well, if you’re on the hunt for a budget-friendly broker to dive into the world of stocks, ETFs, mutual funds, and the usual investment suspects, Vanguard could very well be your golden ticket. It’s got a solid reputation for being both secure and user-friendly. With no minimum deposit required and a promise to cover any losses from unauthorized online transactions, Vanguard takes internet security seriously, employing measures like two-factor authentication. Plus, being under the wing of both SIPC and FINRA means your investments have an extra layer of protection.

However, it’s not all smooth sailing. Active traders and investment newbies might find Vanguard’s platform a tad lacking, especially when it comes to a dynamic trading interface or easily accessible educational resources. And while customer service is there, it’s had its share of mixed reviews.

Vanguard’s Revenue Model and Cost-Effective Strategies

In summary, Vanguard is a solid choice for investors leaning towards a long-term, low-cost investment strategy. Its strengths lie in commission-free trading, low-fee funds, and access to a broad range of account types. However, if you’re more of an active trader or in need of robust educational tools right off the bat, you might want to weigh your options.

Vanguard is often celebrated for its rock-bottom costs, but like any company, it needs to keep the lights on and compensate its team. So, how does Vanguard manage to rake in dough without compromising its reputation for affordability?

- Interest Earnings: Vanguard’s got a knack for making your idle cash work for you. It automatically moves your spare change into money market funds, ensuring you get to pocket every penny of interest that accumulates. And here’s the kicker: they keep the expense ratios laughably low, which means more money in your pocket compared to what you’d get with other brokers. Unlike some of their peers, Vanguard doesn’t pocket the difference between what they earn on these funds and what they pass back to you.

- Payment for Order Flow (PFOF): This is where Vanguard takes a different path. While many brokers boost their bottom line by getting paid to route your trades to certain exchanges, Vanguard steps away from this practice. No PFOF here.

Stock Loans: Vanguard dips its toes into the stock lending pool with the stocks nestled within its ETFs. This modest venture into securities lending directly benefits the funds, and thereby, investors like you, with the proceeds. If you’re holding individual Vanguard portfolios, you won’t see a separate stock loan program because it’s all baked into the ETFs themselves. - Price Improvement: Here’s where you can actually save some cash. Vanguard’s savvy order routing means you could see a net price improvement of $2.31 for every 100 shares traded. That’s money back in your pocket.

- Margin Interest: While leveraging margin might not be the Vanguard way of whispering sweet nothings into the ears of conservative investors, it’s available. And yes, Vanguard makes a penny or two from the interest charged to investors who borrow funds.

- Expense Ratios: Here’s the bread and butter. The expense ratios on Vanguard’s own mutual funds and ETFs do the heavy lifting in terms of revenue. These fees, although famously low, add up to a tidy sum with the sheer volume of invested dollars. This stream of income keeps Vanguard on the steady, without weighing down investors with hefty fees.

In essence, Vanguard crafts a unique blend of earning strategies that align with its ethos of keeping investor costs to a minimum. It’s a balancing act between generating revenue and sticking to their guns on affordability, and so far, Vanguard seems to be walking that tightrope with grace.

What types of investment products does Vanguard offer?

What makes Vanguard unique in the investment community?

How does Vanguard support retirement planning?

Popular queries